patent rights. Given the looseness of the resulting legal restrictions, it is entirely

possible for firms to adjust transfer prices in a tax-sensitive fashion without violating

any laws.” Their analysis of affiliate-level data for American firms indicates that

larger, more international firms, and those with extensive intra-firm trade and high

R&D intensities, are the most likely to use low-tax environments.

Hines (1995) argues furthermore that differences in royalty withholding taxes can

partly explain differences in R&D activity by multinationals in different locations.

His empirical analysis shows that affiliates of US multinationals are more R&D

intensive if located in countries that impose high withholding taxes on royalty

payments, suggesting that local R&D and imported foreign technology are

substitutable to some extent.

While direct taxation within the European Union remains within the competence of

individual Member States, Member State powers must be exercised in accordance

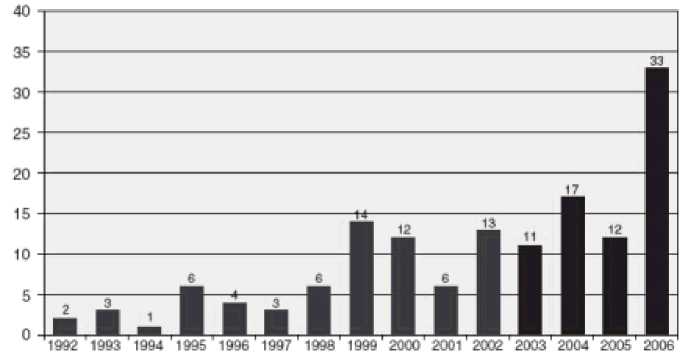

with Community law, and the European Court of Justice (ECJ) has been growing in

importance as an arena in which jurisdictional battles over corporation tax matters are

fought (Figure 1).3

Figure 1. Number of ECJ Cases Involving Direct Taxation, 1992-2006

Source: European Commission, Taxation and Customs Union

The present paper reviews and synthesises these ECJ decisions and analyses their

implications for the FDI decisions of Multinational Corporations. Section 2 provides

background detail on the role and procedures of the ECJ while Section 3, which

comprises the bulk of the paper, discusses ECJ decisions under a number of headings,

including controlled foreign company legislation, treatment of cross-border losses,

cross-border transfer of assets, thin capitalisation/transfer pricing rules, cross-border

transfer of assets, taxation of dividends, exit taxes and double taxation treaties. The

FDI implications of the ECJ decisions reached are discussed at the end of each sub-

section. The final section of the paper offers some concluding comments.

3 The classic statement from the ECJ in relation to direct taxation was set out in Schumaker where the

Court stated that: “although, as Community law stands at present, direct taxation does not as such fall

within the purview of the Community, the powers retained by the Member States must nevertheless be

exercised consistently with Community law”; (Case C-279/93) [1995] ECR I-225, para.21.

More intriguing information

1. Wirkt eine Preisregulierung nur auf den Preis?: Anmerkungen zu den Wirkungen einer Preisregulierung auf das Werbevolumen2. Inflation Targeting and Nonlinear Policy Rules: The Case of Asymmetric Preferences (new title: The Fed's monetary policy rule and U.S. inflation: The case of asymmetric preferences)

3. The name is absent

4. The problem of anglophone squint

5. The name is absent

6. Life is an Adventure! An agent-based reconciliation of narrative and scientific worldviews

7. A Principal Components Approach to Cross-Section Dependence in Panels

8. Rent Dissipation in Chartered Recreational Fishing: Inside the Black Box

9. Kharaj and land proprietary right in the sixteenth century: An example of law and economics

10. Industrial Employment Growth in Spanish Regions - the Role Played by Size, Innovation, and Spatial Aspects