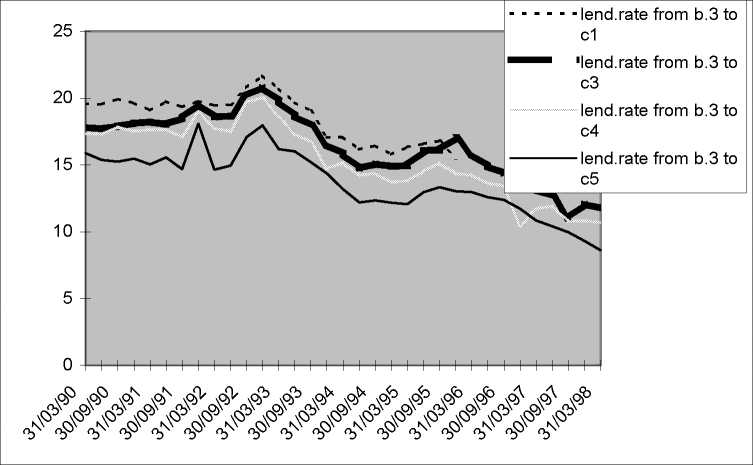

AREA 5

......lend.rate from b.3 to cl

’lend.rate from b.3 to c3

———from b.3 to c4

--------lend.rate from b.3 to c5

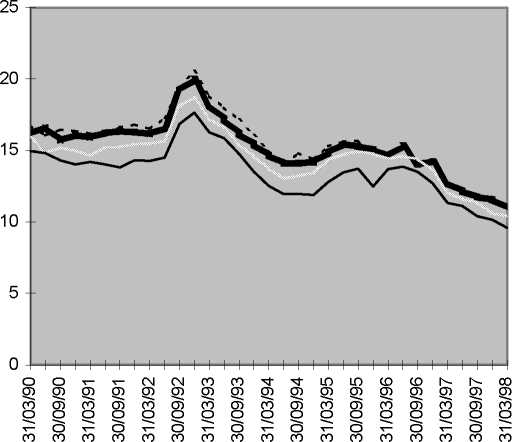

AREA 6

4. Some simple econometrics

Heterogeneity in bank credit and lending rates has been analysed in many different ways, as

briefly discussed in section 2. The approach followed here is both unconventional and very simple. The

first equation estimated (and shown in sub-section 4.1) is meant to investigate on the main determinants

of heterogeneity in lending rates, for a given policy regime and is based on a simple “textbook” statement:

when monetary policy is mainly based (like in the Italian context) on the control of interest rates, the rate

of discount does not only display general attitude of the policy makers, but also constitutes a “topical”

interest rate affecting the whole set of lending rates. The level of the latter will depend on the borrower

risk, competitive context, and demand expectations. In other words, we study the spread between each

specific lending rate (from each size class of lenders to each loan size class, in each geographic area and

19

More intriguing information

1. TOWARDS THE ZERO ACCIDENT GOAL: ASSISTING THE FIRST OFFICER MONITOR AND CHALLENGE CAPTAIN ERRORS2. STIMULATING COOPERATION AMONG FARMERS IN A POST-SOCIALIST ECONOMY: LESSONS FROM A PUBLIC-PRIVATE MARKETING PARTNERSHIP IN POLAND

3. Beyond Networks? A brief response to ‘Which networks matter in education governance?’

4. The name is absent

5. Prizes and Patents: Using Market Signals to Provide Incentives for Innovations

6. The name is absent

7. Visual Artists Between Cultural Demand and Economic Subsistence. Empirical Findings From Berlin.

8. The resources and strategies that 10-11 year old boys use to construct masculinities in the school setting

9. The Veblen-Gerschenkron Effect of FDI in Mezzogiorno and East Germany

10. Commuting in multinodal urban systems: An empirical comparison of three alternative models