The balance-sheet channel operates through the net worth of business firms and this is related

with the ability of firms to borrow. In this literature, the borrower’s financial position is

influenced by the monetary policy and the business cycle. Under a restrictive monetary

policy, the firm’s asset prices are lower reducing the net worth of the firm while the cost of

external financing is higher making investment much more difficult. As Schmidt (1999)

remarks, for firms with problems to access external credit markets, there is an “external

finance premium cost” which is a positive function of the interest rate: the cost moves in the

same direction as a consequence of the own situation of the firm.

Summarising, although there is not a complete agreement (and probably not a full

understanding on the way the monetary policy works), both real economy and financial

factors play a fundamental role in the transmission of monetary policy and in the possible

asymmetries that generates. In the next section, a brief summary on the available empirical

evidence on asymmetries on the transmission of monetary policy and its determinants is done.

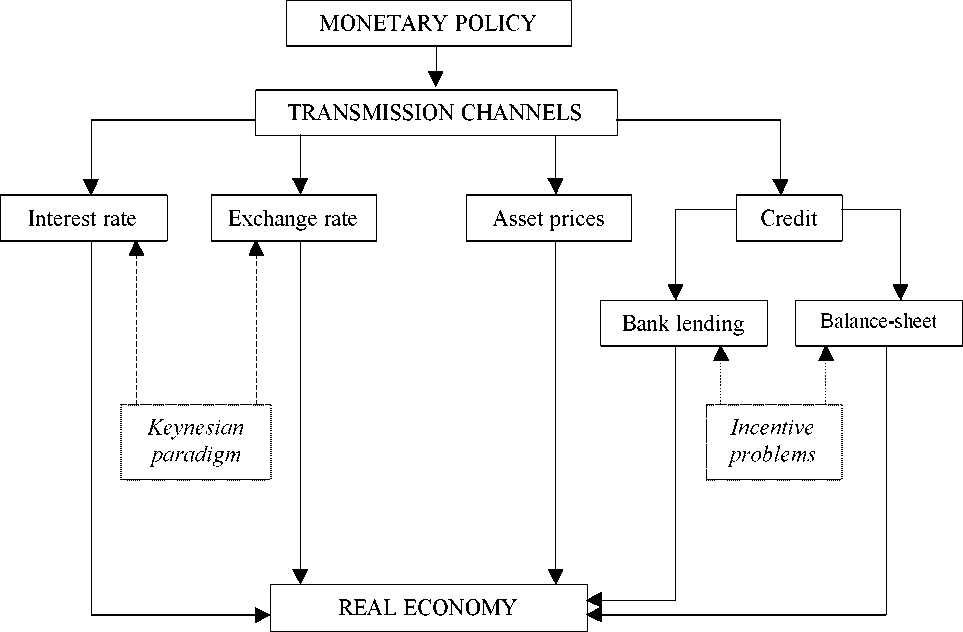

Figure 1. Monetary policy transmission channels

More intriguing information

1. Outline of a new approach to the nature of mind2. Social Irresponsibility in Management

3. Short Term Memory May Be the Depletion of the Readily Releasable Pool of Presynaptic Neurotransmitter Vesicles

4. Standards behaviours face to innovation of the entrepreneurships of Beira Interior

5. The name is absent

6. The name is absent

7. Intertemporal Risk Management Decisions of Farmers under Preference, Market, and Policy Dynamics

8. Estimating the Technology of Cognitive and Noncognitive Skill Formation

9. The name is absent

10. TOWARDS THE ZERO ACCIDENT GOAL: ASSISTING THE FIRST OFFICER MONITOR AND CHALLENGE CAPTAIN ERRORS