The empirical part of the paper makes use of two data sets: One was provided by the division of

‘International Balance of Payments’ at the Austrian National Bank. This data presents the results of a

survey that is conducted annually by roughly 4000 Austrian enterprises that hold at least ATS 1 million

of nominal capital.

A second data set, which is analysed in this paper, presents results of a questionnaire that was conducted

by 1700 Austrian enterprises in the summer of 1997. The enterprises were asked about their specific

motives of investment and their regional sales structure. Hence these data can verify the postulated

objectives of investment.

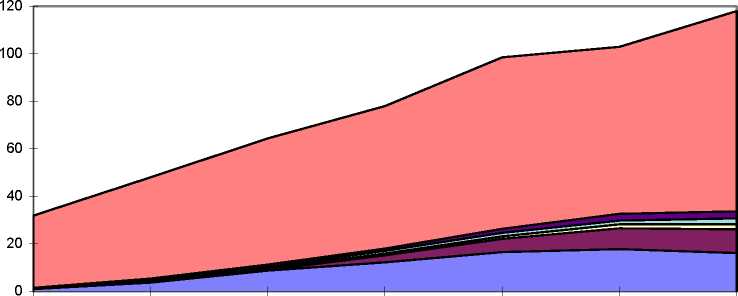

3. Regional and sectoral patterns of Austria’s FDI in the CEECs

The share of outward FDI-stock by GDP can measure the degree of countries’ transnationalisation. This

indicator shows that Austria's ratio is far below the average of other small OECD countries (UNCTAD,

1996, 261f.).5 However, Austria's outward FDI has improved rather quickly during the period of the

opening of the Central and Eastern European economies (see Fig.1).

Fig.1: Austria’s Outward FDI by destinations, 1989-95

(total capital, in ATS billion)

□ Others

□ Other CEECs

□ Slovenia

□ Slovakia

□ Czech Republic

□ Hungary

1989 1990 1991

1992 1993

1994 1995

For Austria this period of 'globalisation' was characterised by two new and substantial economic

developments: the pre-EU-accession period6 and the opening of Eastern European economies. Both of

them have enforced Austria's international economic activities considerably. However, the FDI-stock-

GDP ratio in 1995 was still relatively low. One of the main reasons for this low degree of

internationalisation is Austria's industry structure, especially the prevalence of SMEs. Most of this

specific Austrian economic feature can be explained only by history (see BELLAK, 1997).

In Fig.1 we can see that Austria’s FDI in OECD countries7 has increased from ATS 30.5 billion (95.6%

of total FDI) in 1989 to ATS 84.3 billion (71.4% of total FDI) in 1995. As mentioned above this was

mainly the result of Austria’s accession to the EU and will not be further discussed in this paper.

More intriguing information

1. Knowledge and Learning in Complex Urban Renewal Projects; Towards a Process Design2. Feature type effects in semantic memory: An event related potentials study

3. A Note on Productivity Change in European Co-operative Banks: The Luenberger Indicator Approach

4. Housing Market in Malaga: An Application of the Hedonic Methodology

5. ANTI-COMPETITIVE FINANCIAL CONTRACTING: THE DESIGN OF FINANCIAL CLAIMS.

6. Towards a Mirror System for the Development of Socially-Mediated Skills

7. The name is absent

8. Cultural Diversity and Human Rights: a propos of a minority educational reform

9. The name is absent

10. Sector Switching: An Unexplored Dimension of Firm Dynamics in Developing Countries