Carlos A. Ibarra

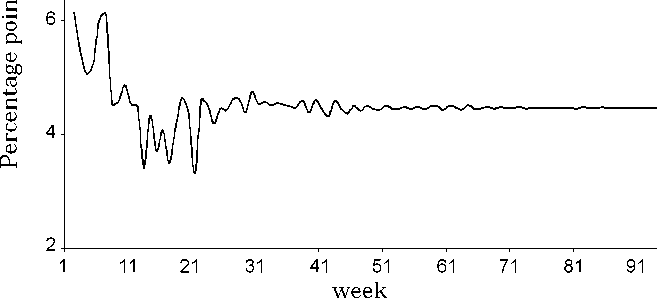

implications from these results were discussed in Section I: the

observed reaction of the interest rate differential to a rise in the

exchange rate may represent a stumbling block for the adoption of an

anti-cyclical monetary policy, and it may also compromise the output

stabilizing properties of the floating regime in the presence of capital

account shocks.

Figure 2. Interest rate differential dynamic response to a 10% currency

depreciation.

III. Explaining the link

This section offers an interpretation of the observed pattern of

interest rate-exchange rate correlations in the Mexican float; the

interpretation focuses on how an inflation-averse central bank may

react to an exogenous currency depreciation, and notes the

implications for the behavior of local interest rates, if private agents

incorporate the central bank reaction function into their expectations

formation process.15

15 The analysis assumes that the central bank reaction function is at least imperfectly

known (and credible) within the private sector.

18

More intriguing information

1. Evolutionary Clustering in Indonesian Ethnic Textile Motifs2. The Macroeconomic Determinants of Volatility in Precious Metals Markets

3. The Clustering of Financial Services in London*

4. Skills, Partnerships and Tenancy in Sri Lankan Rice Farms

5. The name is absent

6. Nurses' retention and hospital characteristics in New South Wales, CHERE Discussion Paper No 52

7. A Multimodal Framework for Computer Mediated Learning: The Reshaping of Curriculum Knowledge and Learning

8. Wirkung einer Feiertagsbereinigung des Länderfinanzausgleichs: eine empirische Analyse des deutschen Finanzausgleichs

9. The Role of Evidence in Establishing Trust in Repositories

10. Momentum in Australian Stock Returns: An Update