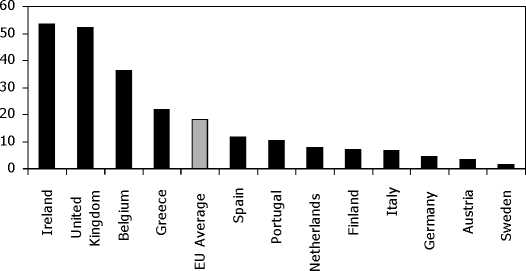

Figure 1: Market Shares of Foreign Banks in the EU (%)

Source: ECB data

Figure 2: Composition of Daily TARGET Transactions

|

Average Size |

Number | |

|

Cross-border transfers |

8.99 Mio. Euro |

53,196 |

|

Domestic transfers |

5.59 Mio. Euro |

189,868 |

Source: ECB TARGET Statistics May 2002

market structure: The daily cross-border interbank transfers are on average

significantly larger than the domestic ones while the number of transactions

is substantially smaller (see Figure 2). This finding is interpreted such that

some large banks start to act as ”money centre” banks which are active in

the whole euro area while smaller banks continue to operate nationally.6 As

these ”money centre” banks form the backbone of the interbank market,

financial problems of one of them could easily spread across borders particu-

larly as the interbank market is characterized by large volumes and absence

of guarantees. Hence, the interbank market is particularly prone to being a

channel for cross-border contagion in the EU.

6See Enria and Vesala (2002).

More intriguing information

1. Pricing American-style Derivatives under the Heston Model Dynamics: A Fast Fourier Transformation in the Geske–Johnson Scheme2. A parametric approach to the estimation of cointegration vectors in panel data

3. Une nouvelle vision de l'économie (The knowledge society: a new approach of the economy)

4. The name is absent

5. Bidding for Envy-Freeness: A Procedural Approach to n-Player Fair Division Problems

6. Does South Africa Have the Potential and Capacity to Grow at 7 Per Cent?: A Labour Market Perspective

7. The name is absent

8. Tobacco and Alcohol: Complements or Substitutes? - A Statistical Guinea Pig Approach

9. Passing the burden: corporate tax incidence in open economies

10. The name is absent