Merz: The Distribution of Income of Self-employed, Entrepreneurs and Professions

4 Income and Tax Revenues within the German Tax System:

Overall Results

Before going into the details of our specific data base, the Income Tax Statistic, we

sketch the size and importance of income and taxes from German tax statistics in

general. This allows to integrate the following results into the general income and tax

situation in Germany.

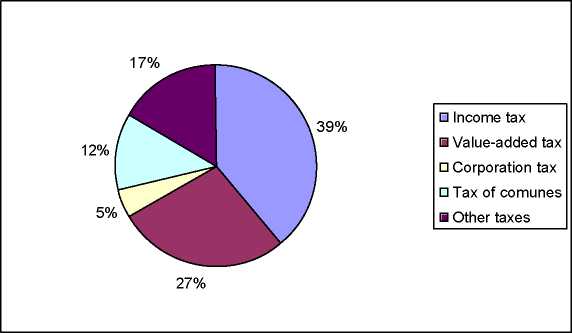

Figure 1 describes the revenue percentages of the overall five tax categories. For 1992

the income tax revenue is 39% of all the tax income out of value added tax (27%), tax

of communes (12%), corporation tax (5%) and other taxes (17%).

Figure 1: Revenue Due to Type of Tax, Germany 1992

Source: Statistical Yearbook 1998

Thus, in 1992 (and all the years ago) the income tax (Einkommensteuer) is the dominant

tax income source within the German tax system. The income tax is divided by the

wage tax (Lohnsteuer) and the assessed income tax (veranlagte Einkommensteuer) with

6,1% resp. 32,9% of total 700.034 Mio. DM tax revenue in 1992.

Being the dominant income source in Germany is only one of the reasons why we

further on rely on this statistic as our data base. In addition, and focussing in particular

on the situation of the self-employed, the income tax statistic - as we shall point out - is

the most informative and realistic microdatabase regarding the final individual income

situation. Beyond that, and important for the representativity of the results, as a tax

statistic this is not a sample statistic but a popuplation statistic including all respective

tax payers.

More intriguing information

1. The name is absent2. Keynesian Dynamics and the Wage-Price Spiral:Estimating a Baseline Disequilibrium Approach

3. The name is absent

4. The name is absent

5. Integrating the Structural Auction Approach and Traditional Measures of Market Power

6. The name is absent

7. Imputing Dairy Producers' Quota Discount Rate Using the Individual Export Milk Program in Quebec

8. SOME ISSUES IN LAND TENURE, OWNERSHIP AND CONTROL IN DISPERSED VS. CONCENTRATED AGRICULTURE

9. The name is absent

10. The name is absent