2.2 The nature of sub-central fiscal autonomy

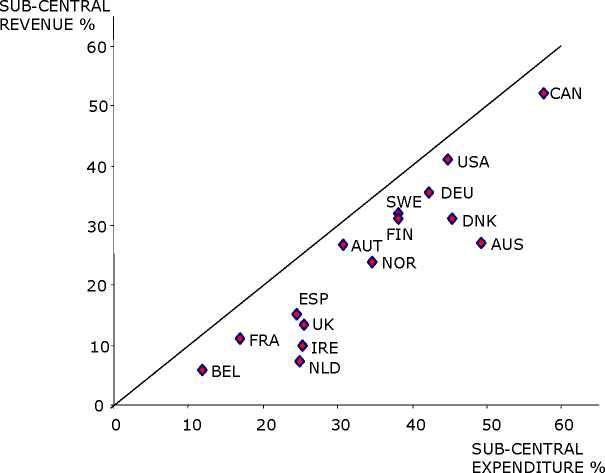

From Figure 1 we can immediately see that, despite a fair degree of cross-country

heterogeneity, sub-central governments tend to play an important role in the conduct of fiscal

policy. On average across the 15 countries, over a third of total fiscal expenditure (35.1%) and

a quarter of revenues (25.6%) are assigned (i.e. under the control of) sub-central governments.

The figure also allows us to see the relative size of fiscal imbalances. The vertical distance

between each point and the 45o line shows how dependent the country’s sub-central tier of

government is on grants from the central tier.

Figure 1: Fiscal Decentralisation

(sub-central expenditure and revenues as percentages of general government totals)

Source: IMF Government Financial Statistics (2002 edition).

Note: figures shown are sample averages.

Figure 2 breaks down expenditure into a number of its key components and shows that sub-

central authorities undertake a sizeable proportion of most categories of general government

expenditure. The existing literature has focused on general government data and has

emphasised the importance of control over the government wage bill. It is therefore of

particular interest to note that, on average, some 61% of the general government wage bill is

accounted for by expenditure at the sub-central level.

More intriguing information

1. Incorporating global skills within UK higher education of engineers2. Hemmnisse für die Vernetzungen von Wissenschaft und Wirtschaft abbauen

3. Long-Term Capital Movements

4. The name is absent

5. AGRICULTURAL PRODUCERS' WILLINGNESS TO PAY FOR REAL-TIME MESOSCALE WEATHER INFORMATION

6. The name is absent

7. Reconsidering the value of pupil attitudes to studying post-16: a caution for Paul Croll

8. The name is absent

9. Naïve Bayes vs. Decision Trees vs. Neural Networks in the Classification of Training Web Pages

10. The Provisions on Geographical Indications in the TRIPS Agreement