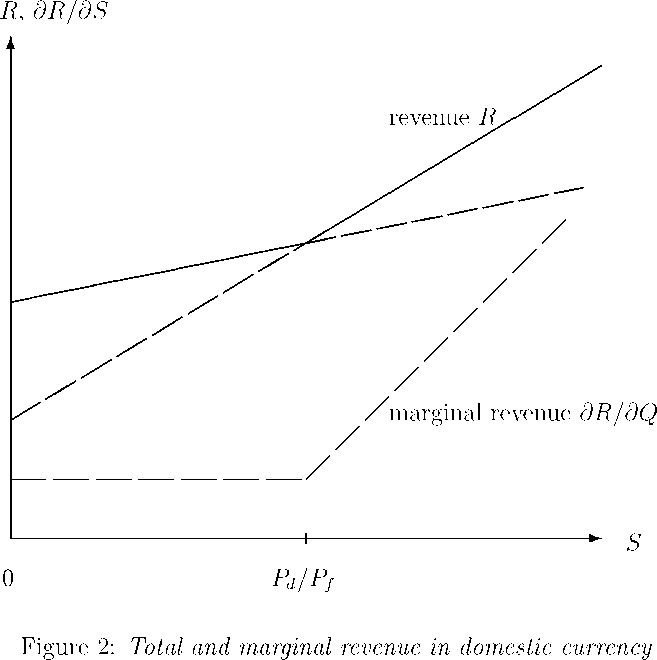

firm’s domestic currency revenue. Figure 2 illustrates this graphically. The steeper thick

line represents the firm’s domestic currency revenue if it exports Q - Qd to the foreign

market. The slope is Pf (Q - Qd). The flatter thick line represents the firm’s domestic

currency revenue if the firm exports only the minimum level, Qf , to the foreign market.

Here, the slope is only PfQf . Since the firm is export flexible, it will always choose a

sales allocation between the domestic and the foreign market that maximizes its domestic

currency revenue. In Figure 2, the domestic currency revenue is represented by the solid

part of the two thick lines, which is convex in S and piecewise linear with positive slope

everywhere. This convexity is created by the possibility to export. Inspection of equation

(2) reveals that this real option is exercised if S exceeds Pd/Pf .

The thin dashed line in Figure 2 represents the dependence of the firm’s marginal

revenue ∂R∕∂Q on the exchange rate S. For exchange rates below Pd/Pf, any additional

unit of output that exceeds (Qd + Qf) is sold in the domestic market. Hence, marginal

More intriguing information

1. Two-Part Tax Controls for Forest Density and Rotation Time2. Human Rights Violations by the Executive: Complicity of the Judiciary in Cameroon?

3. The name is absent

4. Foreword: Special Issue on Invasive Species

5. Second Order Filter Distribution Approximations for Financial Time Series with Extreme Outlier

6. The name is absent

7. Announcement effects of convertible bond loans versus warrant-bond loans: An empirical analysis for the Dutch market

8. The name is absent

9. The name is absent

10. Top-Down Mass Analysis of Protein Tyrosine Nitration: Comparison of Electron Capture Dissociation with “Slow-Heating” Tandem Mass Spectrometry Methods