of the listing, reporting, and disclosure requirements, with the Neuer Markt being more

demanding.

As can be seen in table 1, the huge increase in the number of IPOs, starting in 1997, stems

mainly from new firms that were listed in the new market segment. The other segments do not

show a similar increase in the number of IPOs.6

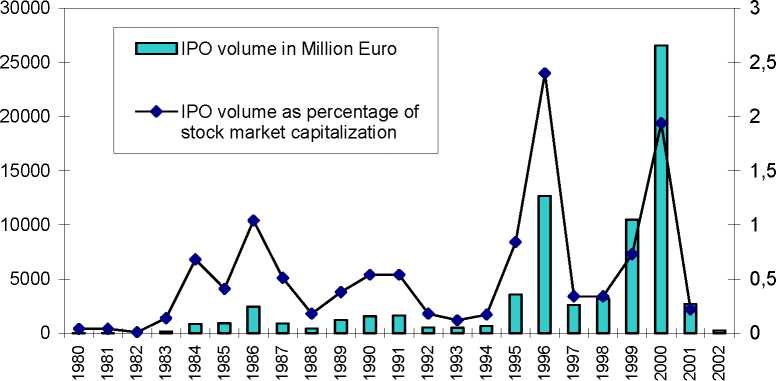

The Deutsche Telekom IPO and the IPO wave on the Neuer Markt are, of course, also

reflected in the yearly total IPO volumes. However, the magnitude of the increase in IPO volume

looks less dramatic if it is related to the market capitalization. Figure 1 reveals the extraordinary

position of the Deutsche Telekom IPO in 1996.7 It is striking that the IPO volume as percentage

of stock market capitalization raised through IPOs in 1986 exceeds that of 1998 or 1999, while

the high relative IPO volume in 2000 is primarily due to the downturn in the stock market in the

second half of 2000.

Figure 1: IPO Volume

In addition to the low number of IPOs in Germany before the IPO boom on the Neuer

Markt, the average age at the time of the listing as well as the average IPO volume are also worth

noting.

6 The number of IPOs on the Geregelter Markt declined as most companies opted for the Neuer Markt.

7 The numbers for figure 1 are taken from the DAI-Factbook 2003.

More intriguing information

1. The name is absent2. Tariff Escalation and Invasive Species Risk

3. From Communication to Presence: Cognition, Emotions and Culture towards the Ultimate Communicative Experience. Festschrift in honor of Luigi Anolli

4. A model-free approach to delta hedging

5. Political Rents, Promotion Incentives, and Support for a Non-Democratic Regime

6. A COMPARATIVE STUDY OF ALTERNATIVE ECONOMETRIC PACKAGES: AN APPLICATION TO ITALIAN DEPOSIT INTEREST RATES

7. The name is absent

8. The name is absent

9. The name is absent

10. Tax Increment Financing for Optimal Open Space Preservation: an Economic Inquiry