It is clear from the equation for the budget constraint with borrowing (equation 6)

that the expected return on investment must equal or exceed the cost of borrowed funds rb

in order for a rational individual to borrow.

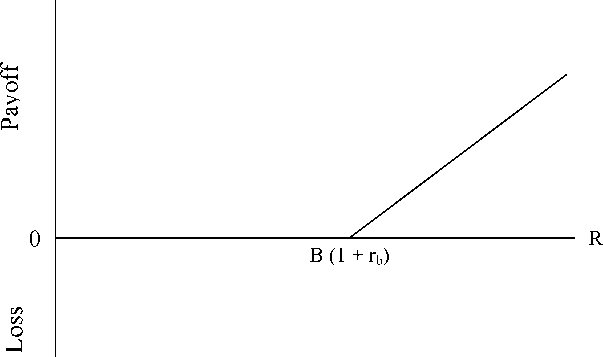

The borrower faces the prospect that the risky project will not succeed, in which

case the payoff structure takes the form of an option. Borrowed funds B are not repaid,

and C1 is limited to the amount saved. The borrower’s payoff is represented by an

asymmetric function, which illustrates the incentive to default. Figure 3 illustrates the

borrower’s option to default. The total value of the investment in period 2 is R. Because

the project is a risky venture, outcomes for R can be anywhere along the horizontal axis,

from worthless to a large amount. When R is resolved at a large value, the borrower has

an incentive to repay the loan plus interest and gains positive payoff of the project value

R above the debt repayment. When R is small, or when 0, the borrower has the incentive

to default. The borrower’s payoff is a call option, or opportunity to reduce losses to 0

through defaulting on debt B.

Figure 3. Borrower’s payoff structure with default option

Ignoring all social or institutional pressures for the moment, the payoff to a borrower can

be represented in monetary terms as:

10

More intriguing information

1. On the Existence of the Moments of the Asymptotic Trace Statistic2. Regulation of the Electricity Industry in Bolivia: Its Impact on Access to the Poor, Prices and Quality

3. Towards a framework for critical citizenship education

4. PER UNIT COSTS TO OWN AND OPERATE FARM MACHINERY

5. Partner Selection Criteria in Strategic Alliances When to Ally with Weak Partners

6. The name is absent

7. The East Asian banking sector—overweight?

8. The name is absent

9. Midwest prospects and the new economy

10. Who is missing from higher education?