The cash outflow postponement component assumes the same value at t0, t1 and at t2

while it is zero at t3 (at expiry the cash outflow cannot be postponed any longer). Moreover

it is independent from the project value. The reversibility component decreases with time

and at any date tn it is a monotonic decreasing function of the value of the project.

Conversely the opportunity cost (lost payout component) is independent of time, whereas it

linearly increases with the value of the project.

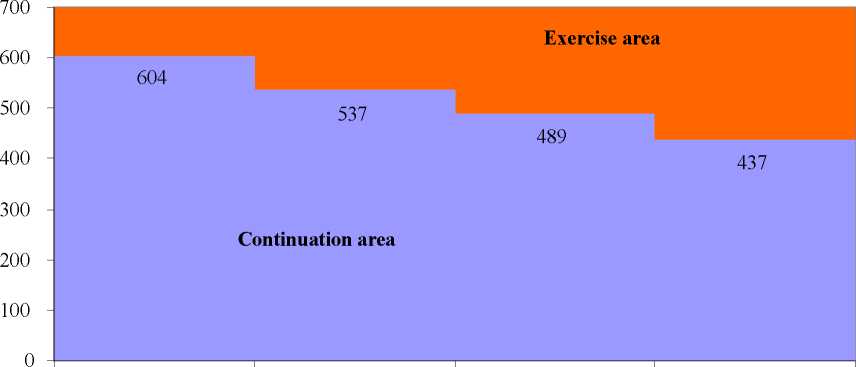

A simple argument establishes that at any tn the optimal stopping policy can be

expressed in the following terms: exercise if Stn>S*tn; do not exercise otherwise. The

optimal stopping rules reflects the intuition that when the stock price is sufficiently high the

probability of incurring losses at expiry is quite low (low protection) while the lost payout

due to because of waiting becomes significant (high opportunity cost).

Since the value of protection falls with time, the critical values S*tn, above which it is

optimal to carry out the project, decreases as the date of expiry becomes closer (see Figure

7).

Figure 7 -Critical values S*t0, S*t1, S*t2 and S*t3

t0 t1 t2 t3

18

More intriguing information

1. Regional specialisation in a transition country - Hungary2. The name is absent

3. Can we design a market for competitive health insurance? CHERE Discussion Paper No 53

4. The name is absent

5. Staying on the Dole

6. Determinants of Household Health Expenditure: Case of Urban Orissa

7. The name is absent

8. The name is absent

9. The name is absent

10. The name is absent