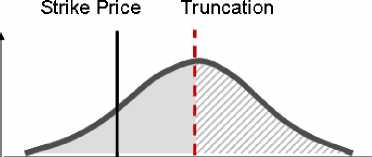

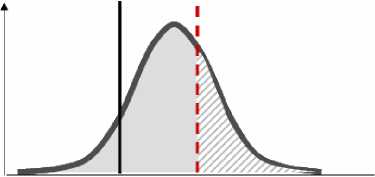

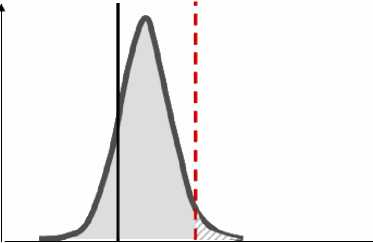

possible NPVs, i.e. the present value of cash flows from the expiry date onwards, which

will arise at the expiry date of the option which we assumed to be t3. As we move from t0 to

t3, the spread of the expected distribution of the NPVs at t3 becomes smaller, as uncertainty

on the project outcome wanes (and the value of reversibility is reduced as a consequence).

By the time we reach the expiry date, t3, there is hardly any uncertainty left: the distribution

collapses to a single value of the net present value of the project, which we assume to be

known. As we described earlier, the decision rule is that, if at t3 the present value of cash

flows onwards (NPV) exceeds the strike price, then the investment is carried out; otherwise

the investment is waived for ever (see Figure 8).

Figure 8 -Some truncation effects

Strike Price Truncation

Strike Price Truncation

20

More intriguing information

1. Reform of the EU Sugar Regime: Impacts on Sugar Production in Ireland2. MANAGEMENT PRACTICES ON VIRGINIA DAIRY FARMS

3. The name is absent

4. ‘Goodwill is not enough’

5. Testing Hypotheses in an I(2) Model with Applications to the Persistent Long Swings in the Dmk/$ Rate

6. Creating a 2000 IES-LFS Database in Stata

7. Searching Threshold Inflation for India

8. The name is absent

9. Olfactory Neuroblastoma: Diagnostic Difficulty

10. Deprivation Analysis in Declining Inner City Residential Areas: A Case Study From Izmir, Turkey.