Now,

k = ck = о, iff

k(py,w,k)- ckm(py,w,rn,k) + pmrn = O

(6)

If condition (6) holds then the cooperative firm is behaving “as if’ it were maximising πk. The price

it pays for its raw material pm is chosen consistent with maximising the returns to the given

quantity of raw materials and the capital stock. Hence this price is sometimes referred to as the

“virtual” price (Neary and Roberts (1980)) denoted here for convenience as pvm. In other words, if

(6) holds then the amount of raw material processed is exactly equivalent to what a profit-

maximising firm would have freely processed when faced with a given price pm. Thus from an

economic perspective if pm= p,,,^en equations (3) - (4) are identical to (1) - (2). We could thus

characterise such a cooperative as a virtual profit-maximising firm (VPMF for short).

Of course this conceptual framework can be extended further to the case where capital is assumed

to be variable even in the short run. The conditions for the cooperative firm to be a “virtual” profit

maximiser in these circumstances are given in (7):

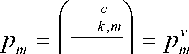

∖ m J

(7)

( c λi

k,m

More intriguing information

1. The InnoRegio-program: a new way to promote regional innovation networks - empirical results of the complementary research -2. The Impact of Hosting a Major Sport Event on the South African Economy

3. Road pricing and (re)location decisions households

4. Une nouvelle vision de l'économie (The knowledge society: a new approach of the economy)

5. PACKAGING: A KEY ELEMENT IN ADDED VALUE

6. Empirically Analyzing the Impacts of U.S. Export Credit Programs on U.S. Agricultural Export Competitiveness

7. MULTIMODAL SEMIOTICS OF SPIRITUAL EXPERIENCES: REPRESENTING BELIEFS, METAPHORS, AND ACTIONS

8. The name is absent

9. Implementation of Rule Based Algorithm for Sandhi-Vicheda Of Compound Hindi Words

10. The name is absent