where,

pvk = the “virtual” price of capital.

A big advantage of the duality approach is that is allows a clear comparison between the behaviour

of the CMF and the PMF. In general:

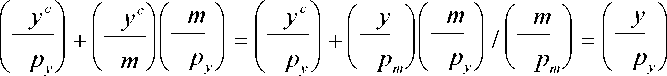

(8)

This expression is referred by Chambers (1988) as the “fundamental duality inequality”. It

implies that profits of the PMF must be at least equal to those generated by the CMF. More

specifically it implies that the profit function of the PMF is in general “more convex” in respect of

output and variable input prices. By implication responses to price changes will be more sluggish

for the CMF compared to the PMF8. The intuition for this result can be understood by comparing

the price responses of the PMF and the CMF.

If the cooperative firm behaves as a virtual profit maximiser then:

yc(pypv,k,m (py,w,k,pm)) = y (py,w,k,pm)

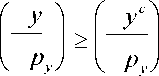

Similar results can be established for the all other price responses9. It will be noted that a sufficient

condition for the cooperative and profit maximising firms to have identical price responses is if:

(10)

It is important to note that the CMF will not exhibit perverse price responses.

10

More intriguing information

1. EMU: some unanswered questions2. Dual Inflation Under the Currency Board: The Challenges of Bulgarian EU Accession

3. Großhandel: Steigende Umsätze und schwungvolle Investitionsdynamik

4. DISCUSSION: ASSESSING STRUCTURAL CHANGE IN THE DEMAND FOR FOOD COMMODITIES

5. The name is absent

6. The name is absent

7. The name is absent

8. Tissue Tracking Imaging for Identifying the Origin of Idiopathic Ventricular Arrhythmias: A New Role of Cardiac Ultrasound in Electrophysiology

9. The name is absent

10. Housing Market in Malaga: An Application of the Hedonic Methodology