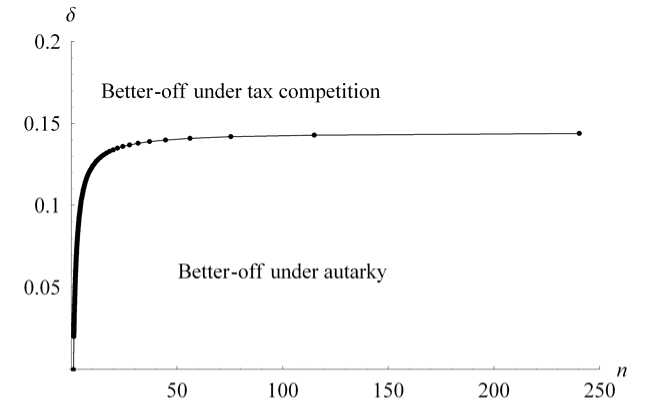

Figure 1: The borderline between welfare-increasing and welfare-reducing tax

competition (I)

fare rises above the autarky level, because the positive effect of rent destruction

dominates the negative effect of lower public goods provision. However, as the

number of countries increases from eight to nine, implying an increase in the tax

base elasticity from 0.4682 to 0.4737, the welfare gain from tax competition is

turned into a slight loss, as the negative efficiency effect of reduced public service

provision starts to dominate. Indeed, in this particular example the maximum

welfare gain from tax competition is attained already when the number of coun-

tries is two, at a tax base elasticity of about 0.3. Given our calibration, this tax

base elasticity represents the optimal intensity of tax competition.

Of course these results are sensitive to the choice of parameter values. One

critical parameter is the degree of political distortion, δ . As the value of this

parameter increases, it takes a higher intensity of tax competition - reflected in

the number of countries and the associated elasticity of the tax base - before

the negative welfare effect of reduced public goods provision starts to dominate

the positive welfare effect of rent destruction. This is illustrated in figures 1

and 2 which show the combinations of the political distortion and the number

of competing jurisdictions (and the implied tax base elasticity) that will lead to

exactly the same level of welfare as that attained under autarky, given the other

parameter values stated in the note to Table 1. For parameter combinations above

22

More intriguing information

1. The name is absent2. The name is absent

3. A Classical Probabilistic Computer Model of Consciousness

4. Modeling industrial location decisions in U.S. counties

5. Informal Labour and Credit Markets: A Survey.

6. Achieving the MDGs – A Note

7. RETAIL SALES: DO THEY MEAN REDUCED EXPENDITURES? GERMAN GROCERY EVIDENCE

8. Models of Cognition: Neurological possibility does not indicate neurological plausibility.

9. Foreign Direct Investment and Unequal Regional Economic Growth in China

10. Economie de l’entrepreneur faits et théories (The economics of entrepreneur facts and theories)