The Interest Rate-Exchange Rate Link in the Mexican Float

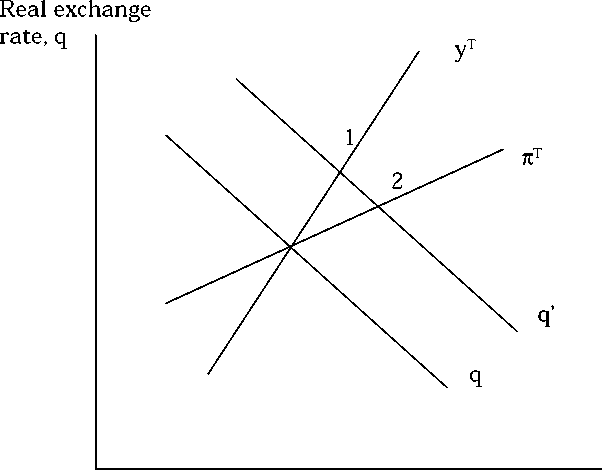

Figure 4. Output and inflation targets under expansionary

depreciation.

Interest rate, i

the current period of peso floating. The results indicate that, even

considering a long lag structure, a weakening in today’s exchange rate

leads to a protracted increase in the interest rate differential. This

stands in contrast to an assumption commonly found in policy-oriented

macroeconomic models, and has potentially important implications.

In particular, given the discussion summarized in the previous

paragraph, the observed dynamic reaction of the peso interest rate

represents a stumbling block for the conduct of an anti-cyclical

monetary policy and compromises the output stabilizing properties of

the floating currency regime in the presence of capital account shocks.

It could be considered whether the results obtained are biased

by the single-equation estimation approach that has been followed.

As is well known, VARs are widely used in the field. However, in the

present context a VAR methodology was unattractive given the

purpose of studying the dynamic response of the interest differential

to an exchange rate change holding the rest as a constant, in

particular holding the policy stance unchanged. The intention was

25

More intriguing information

1. La mobilité de la main-d'œuvre en Europe : le rôle des caractéristiques individuelles et de l'hétérogénéité entre pays2. The Impact of Minimum Wages on Wage Inequality and Employment in the Formal and Informal Sector in Costa Rica

3. The effect of classroom diversity on tolerance and participation in England, Sweden and Germany

4. Palvelujen vienti ja kansainvälistyminen

5. The name is absent

6. Putting Globalization and Concentration in the Agri-food Sector into Context

7. The name is absent

8. INTERPERSONAL RELATIONS AND GROUP PROCESSES

9. Olfactory Neuroblastoma: Diagnostic Difficulty

10. Non Linear Contracting and Endogenous Buyer Power between Manufacturers and Retailers: Empirical Evidence on Food Retailing in France