William Davidson Institute Working Paper 487

itself can be interpreted as an application of this theory since the legally pegged exchange

rate is de facto a common currency (composite good in Hicks's terminology).

(vi) Is it necessary to debate on the optimal price level when after all under the

circumstances of the CB monetary authorities have no influence on inflation (since

Balassa-Samuelson effect is an equilibrium phenomenon)5? In fact they can just observe

it and cannot change it through monetary policy instruments and operations.

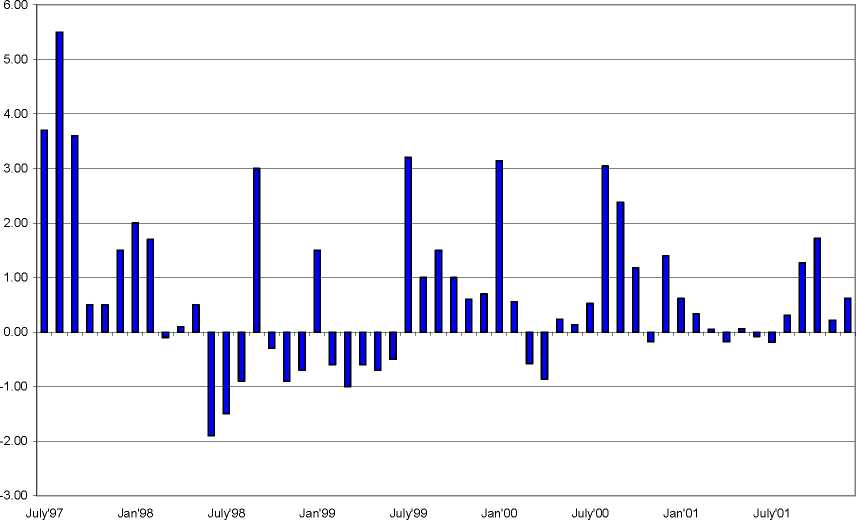

Figure 1. Inflation Dynamics under the CB in Bulgaria

Source: NSI.

To answer the above questions at least partially, we have chosen the following

structure. In Section 2 we will point out all sources of inflation under the CB in the

process of accession. We will stress particularly on the BS explanation focusing on its

specificities in the transition economy. This is the section where we present the empirical

5 The focus of the impact on inflation is moved onto the fiscal policy.

More intriguing information

1. Flatliners: Ideology and Rational Learning in the Diffusion of the Flat Tax2. The name is absent

3. The magnitude and Cyclical Behavior of Financial Market Frictions

4. A COMPARATIVE STUDY OF ALTERNATIVE ECONOMETRIC PACKAGES: AN APPLICATION TO ITALIAN DEPOSIT INTEREST RATES

5. Housing Market in Malaga: An Application of the Hedonic Methodology

6. Why Managers Hold Shares of Their Firms: An Empirical Analysis

7. FISCAL CONSOLIDATION AND DECENTRALISATION: A TALE OF TWO TIERS

8. Strategic Effects and Incentives in Multi-issue Bargaining Games

9. The name is absent

10. Manufacturing Earnings and Cycles: New Evidence