nominal rate is fixed, a positive inflation differential with respect to the foreign countries will

appreciate the currency. In addition, higher domestic inflation, if brought about by an increase in

demand, implies a higher rate of interest, which, in turn, increases net capital inflows. This

increases the rate of inflation and overvalues the currency further. However, nearing 2001, the

real exchange rate for Russia is found to be approaching the equilibrium values.

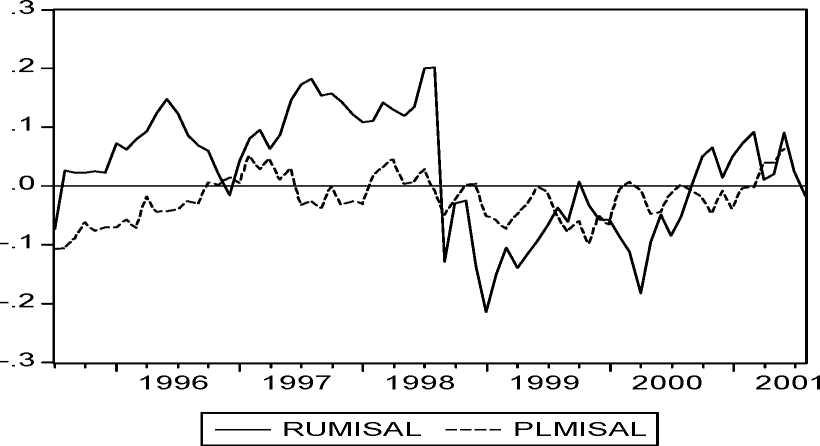

Fig 4. Poland and Russia: real exchange rate misalignments

Misalignment, M = log(e)- log(eeq)

RUMISAL: misalignment for Russia; PLMISAL: misalignment for Poland

These results corroborate the claim by Chapman and Mulino (2000) and Kharas, Pinto and

Ulatov (2001) that the Russian crisis has features in common with first generation crisis models:

the overvalued currency and the government’s inability to manage the fiscal deficit were

inconsistent, which ultimately led to the abandonment of the exchange rate regime itself. Finally,

it is found that the average misalignment in Russia for the entire period is 8.8%, 150% greater

39

More intriguing information

1. Problems of operationalizing the concept of a cost-of-living index2. El impacto espacial de las economías de aglomeración y su efecto sobre la estructura urbana.El caso de la industria en Barcelona, 1986-1996

3. Explaining Growth in Dutch Agriculture: Prices, Public R&D, and Technological Change

4. A NEW PERSPECTIVE ON UNDERINVESTMENT IN AGRICULTURAL R&D

5. Dendritic Inhibition Enhances Neural Coding Properties

6. The name is absent

7. Thresholds for Employment and Unemployment - a Spatial Analysis of German Regional Labour Markets 1992-2000

8. Altruism with Social Roots: An Emerging Literature

9. The name is absent

10. The WTO and the Cartagena Protocol: International Policy Coordination or Conflict?