Turkish Income Tax System to national income. Also the elasticity figures will enable us to make policy

implications about the government’s fiscal policy actions and the tax system.

In the second section, first data and methodology are provided, and then empirical results are presented. The third

and final section concludes the paper.

2. EMPIRICAL ANALYSIS

2.1. Methodology and data

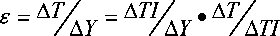

Tanzi’s method of income tax elasticity estimation is based on the following formula:

(1)

where TI = taxable income, T = tax revenue, Y = adjustable gross income

Income tax elasticity, ε, can be calculated in two ways: either by estimating equations (2) and (3) below and

multiplying the coefficients of the independent variables, or by estimating equation (4) where the coefficient of the

independent variable on the right hand side. These two estimates from two different estimations should be

approximately equal.

ln T = ln b0 + b11ln(TI ) (2)

ln TI = ln b0 + b12 ln(K ) (3)

ln T = ln b 0 + b13ln(Γ ) (4)

where ε = b11 ∙ b12 or b11 ∙ b12 = b13 = ε

Our data from 1975 to 2005 is annual. The data for Y (nominal GNP) is taken from the statistics releases of State

Planning Organization of Turkey. Income tax revenue, represented by T is obtained from the Revenue

Administration of Ministry of Finance. Taxable Income, TI, is thought to be similar to Personal Income according

to national accounting concept because theoretically, direct taxes are levied upon Personal Income. Personal

disposable income is obtained by subtracting direct taxes are from personal income. In this study, personal income

is used as taxable income. The definition of Personal Income is the total income of the citizens of a country before

the Income Taxes in a certain period of time. The taxable income series are calculated by the authors as follows:

GNP = GDP + Net Factor Income from Abroad

Net National Product = GNP - Depreciation

National Income (NI) = Net National Product - Indirect Taxes

Personal Income or Taxable Income = NI - (Social Security Payments + Corporate Taxes) + Domestic Interest

Payments + Transfer Payments

The aggregate numbers of depreciation in the period 1975-2005 for Turkey cannot be obtained so the calculation is

done without depreciation figures. Other series are taken from State Planning Organization of Turkey and from the

More intriguing information

1. From music student to professional: the process of transition2. THE ECONOMICS OF COMPETITION IN HEALTH INSURANCE- THE IRISH CASE STUDY.

3. Ronald Patterson, Violinist; Brooks Smith, Pianist

4. The name is absent

5. The name is absent

6. How to do things without words: Infants, utterance-activity and distributed cognition.

7. SAEA EDITOR'S REPORT, FEBRUARY 1988

8. MANAGEMENT PRACTICES ON VIRGINIA DAIRY FARMS

9. The name is absent

10. The ultimate determinants of central bank independence