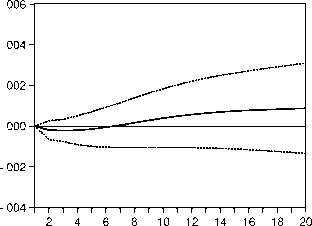

Response of P to MSW

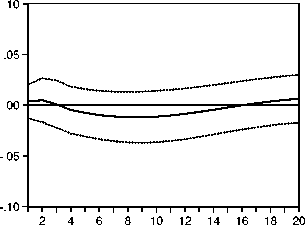

Response of M to MSW

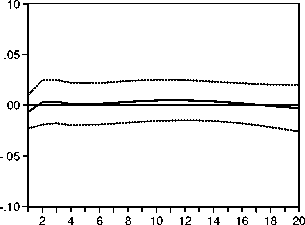

Response of MSW to IS

Figure 5: Impulse response analysis; model with house prices and stocks

Response of MSW to M

with respect to money demand. As rising share prices contribute to wealth, and with

money demand depending more on wealth than on income, this effect makes sense

from a theoretical perspective.17 Note that these results are robust to an estimation

of the model in which only share prices and not the house price index are included.

We propose at least two possible interpretations for our finding that stock prices

do not react to monetary conditions. Either share prices are difficult to model ade-

quately within a standard macroeconomic framework or they are mainly determined

by fundamental criteria like future cash flow expectations or price earnings ratios

assuming that the latter are independent from monetary policy. Thus, the special

role we found for house prices among asset prices in our theoretical considerations

is clearly confirmed in our empirical investigation.

17See European Central Bank (2007) for some recent empirical findings that show a close link

between money and wealth in the Euro area.

22

More intriguing information

1. The name is absent2. The name is absent

3. The name is absent

4. Who runs the IFIs?

5. The name is absent

6. Financial Market Volatility and Primary Placements

7. Luce Irigaray and divine matter

8. The Trade Effects of MERCOSUR and The Andean Community on U.S. Cotton Exports to CBI countries

9. ANTI-COMPETITIVE FINANCIAL CONTRACTING: THE DESIGN OF FINANCIAL CLAIMS.

10. The name is absent