Country 1, ∆ Real wages

9

8

7

6

5

4

3

τ (%)

γ

10 60

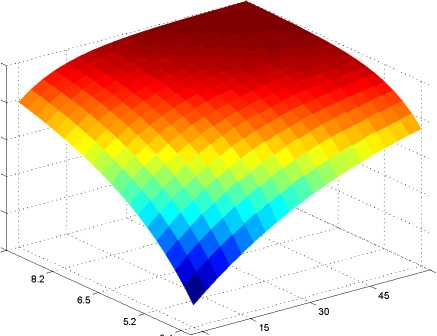

Country 2, ∆ Real wages

0

-0.5

-1

-1.5

-2

-2.5

10

60

0

γ τ (%)

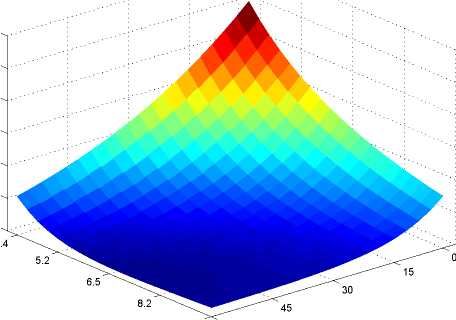

Figure A5: Change in real wages [on the vertical axis] as a function of trade costs and

the shape parameter of the Pareto distribution for a given change of b1 from 0.4 to 0.8.

Result A6a [Spill-overs in the Krugman economy]

If firms are homogenous and external economies of scale are important (ν = 1), then an

increase of unemployment benefits in country 1 leads to a decrease of real wages in all

countries.

The increase in unemployment is accompanied by a loss in real wages in all countries,

as is shown in Figure A6. The main reason here is that due to less varieties and higher

prices, the overall price level rises. This is a result of the external economies of scale. As

in the Krugman model with perfect labor markets, larger markets imply lower prices and

higher real wages. Hence, if unemployment goes up, the opposite effects occur.

Result A6b [Spill-overs in the Krugman economy without external economies

of scale]

If firms are homogenous and there are no external economies of scale (ν = 0), an increase

in unemployment benefits in one country will have ambiguous wage effects in that country

while in all other countries wages increase.

Figure A7 plots real wages when firms are homogenous and external economies of scale

are not important. In this case, the effects on real wages for country 1 are ambiguous.

On the one hand, home varieties become relatively more expansive as foreign varieties,

implying higher costs of living, and hence, lower real wages. On the other hand, higher

unemployment benefits lead to higher equilibrium bargained nominal wages. The net

effect is ambiguous. For the trading partner, the compositional effect implies a gain

in attractiveness, leading to relative lower prices for home varieties relative to foreign

varieties. This leads to a fall of the costs of living and therefore to higher real wages.

Note that this compositional effect again vanishes as for unemployment if all varieties

enter the price index symmetrically, which is the case when trade costs are zero. Hence,

real wages do not change at all if τ = 1.

55

More intriguing information

1. Place of Work and Place of Residence: Informal Hiring Networks and Labor Market Outcomes2. The Impact of Financial Openness on Economic Integration: Evidence from the Europe and the Cis

3. Innovation Policy and the Economy, Volume 11

4. MANAGEMENT PRACTICES ON VIRGINIA DAIRY FARMS

5. SOME ISSUES IN LAND TENURE, OWNERSHIP AND CONTROL IN DISPERSED VS. CONCENTRATED AGRICULTURE

6. Ruptures in the probability scale. Calculation of ruptures’ values

7. The name is absent

8. European Integration: Some stylised facts

9. Family, social security and social insurance: General remarks and the present discussion in Germany as a case study

10. Industrial Employment Growth in Spanish Regions - the Role Played by Size, Innovation, and Spatial Aspects