-29-

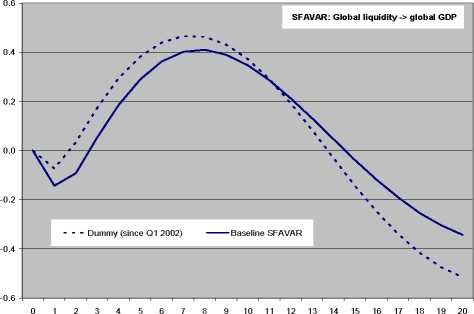

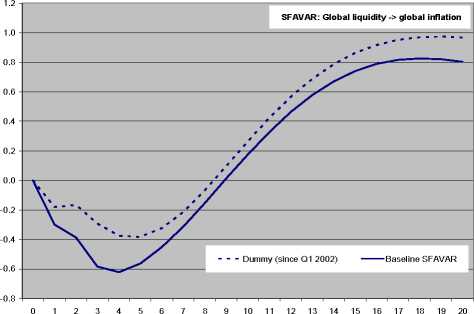

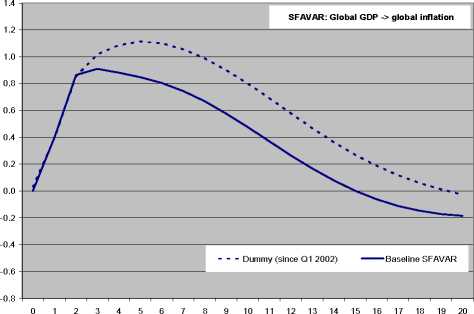

Chart 4 - Impulse response analysis in SFAVAR (dummy approach)

In the next step, we examine the stability of the global structural shocks. Under

the null hypothesis that there is no break in the variance, E | ηt(τ)| is constant. We

therefore test for a break by implementing the Quandt-Andrews test in the regression of

| ηt (τ) | against a constant, using homoskedastic standard errors (which are valid under

the null). Accordingly, apart from the short-term interest rate innovations, there is no

indication of sharp structural breaks. The estimated break date for global interest rate

shocks is Q1 1991. Given that such a sharp break may still be part of an ongoing trend,

we additionally test for more gradual changes in the global short-term interest rate

shocks. The regression is augmented with a time trend (Stock, Watson 2002). The null

hypothesis of no sharp break is not rejected again. The coefficient sign of time trend is

significantly negative, thereby reflecting that the magnitude of the shocks is decreasing

over time.

More intriguing information

1. The name is absent2. The name is absent

3. TLRP: academic challenges for moral purposes

4. Psychological Aspects of Market Crashes

5. The Modified- Classroom ObservationScheduletoMeasureIntenticnaCommunication( M-COSMIC): EvaluationofReliabilityandValidity

6. The name is absent

7. The name is absent

8. Family, social security and social insurance: General remarks and the present discussion in Germany as a case study

9. Target Acquisition in Multiscale Electronic Worlds

10. The name is absent