railway company) from financial to real transactions. Two months later, in May 2005, the

2001 deficit was estimated to be 3.2 percent of GDP mainly because of the upward

revision of transfers to firms. Finally, in March 2006, due to a GDP upward revision, the

2001 deficit was indicated to be 3.1 percent of GDP.

The overall revision can be interpreted in terms of the deficit-specific SFA component (x)

considered in the previous section: x was initially overestimated. More specifically, the

deficit revision reflects a reduction of the cash-accrual adjustment by 0.6 percentage

points of GDP, an increase in the sale of assets by 0.6 points (the reclassification of

securitization), and a reduction in acquisitions of financial assets by 0.5 points (mainly,

the reclassification of capital injections in the railway company).

The decline initially reported for the deficit between 2000 and 2001 (from 1.7 percent to

1.4 percent of GDP) was in sharp contrast with the dynamics of the change in debt.

According to the data available in March 2002, the latter rose from 1.6 percent of GDP in

2000 to 3.5 percent in 2001. This indicator turned out to be more stable than ESA95 net

borrowing: overall, it was revised upwards by 0.7 percentage points of GDP; moreover,

revisions took place only up to March 2003.

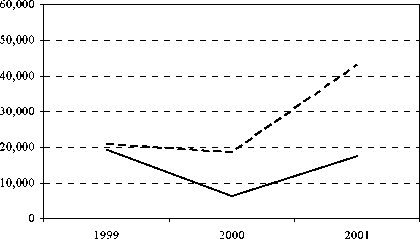

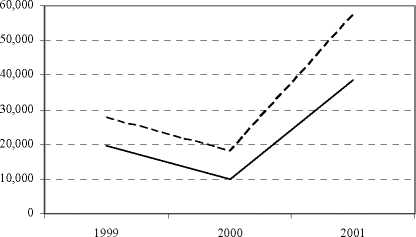

Figure 6.1 Italy: Net Borrowing and Change in Debt (millions of euro)

A - The picture taken in March 2002 B - The picture taken in March 2006

-------Net borrowing----Change in debt

-------Net borrowing----Change in debt

Figure 6.1 shows the divergence between the ESA95 deficit and the change in debt as it

first appeared in March 2002 (Panel A) and as it appears now (Panel B). After the

revisions, the dynamics of the ESA95 deficit is clearly closer to that of the change in

debt. The joint examination of the indicators could have provided an early warning of the

likely forthcoming revisions. Banca d’Italia in its Annual Report released in May 2002 in

fact carried out this comparative exercise.116

Portugal: the 2001 Deficit Outturn

In March 2002 - in its first notification about the 2001 fiscal outcomes - Portugal

estimated the general government deficit to be 2.2 percent of GDP as against 1.5 percent

in 2000. At that time, the most up-to-date deficit forecasts by international institution

were somewhat more favourable.

Eurostat stated that it was not in a position to certify the Portuguese figures due to, among

other reasons, the lack of information on capital injections to public corporations - which

The Report also included an analysis of the composition of total SFA.

169

More intriguing information

1. The name is absent2. DIVERSITY OF RURAL PLACES - TEXAS

3. The name is absent

4. Name Strategy: Its Existence and Implications

5. ROBUST CLASSIFICATION WITH CONTEXT-SENSITIVE FEATURES

6. Lumpy Investment, Sectoral Propagation, and Business Cycles

7. Bridging Micro- and Macro-Analyses of the EU Sugar Program: Methods and Insights

8. The name is absent

9. The name is absent

10. The name is absent