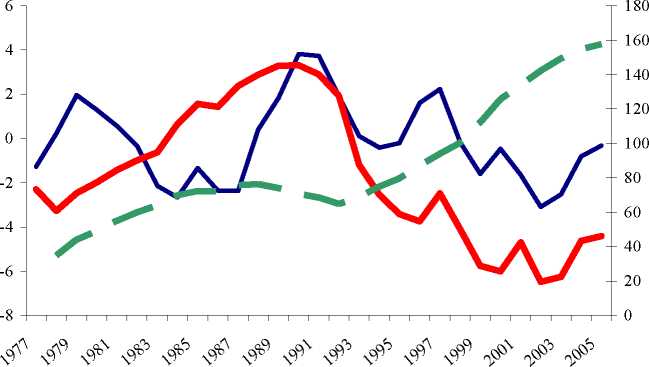

Figure 2.1 (continued)

Japan

Table 2.3 presents summary statistics related to the estimation of model (2.10) by

ordinary least squares (OLS). A positive and statistically significant (at 5% at least)

response is observed in Belgium, Spain, Italy, Netherlands, Portugal, Denmark, Sweden,

UK and the US. In the rest of the countries, except in Japan, the reaction of the primary

balance to debt stocks is either significant at 10% (Ireland and Austria) or non-significant,

although the estimate is positive. Only in Japan, the estimate is negative but non-

significant. When significant, the reaction of the primary surplus to the output gap is

positive, thus pointing to counter-cyclical fiscal policies. This seems to be the case in

most EU Member States not in the euro area, as well as Finland, Austria and, to a much

lesser extent, Portugal. In Belgium, Germany, Greece and Ireland the correlation between

the primary balance and the output gap is negative albeit non-significant. Finally, in all

the countries, except in Portugal, the inertia is statistically significant, positive indeed and

in some cases relatively strong. In countries like Ireland, Japan and, to a lesser extent,

Belgium, UK and US it appears pretty close to 1.

33

More intriguing information

1. Demographic Features, Beliefs And Socio-Psychological Impact Of Acne Vulgaris Among Its Sufferers In Two Towns In Nigeria2. National urban policy responses in the European Union: Towards a European urban policy?

3. The name is absent

4. TWENTY-FIVE YEARS OF RESEARCH ON WOMEN FARMERS IN AFRICA: LESSONS AND IMPLICATIONS FOR AGRICULTURAL RESEARCH INSTITUTIONS; WITH AN ANNOTATED BIBLIOGRAPHY

5. The name is absent

6. The name is absent

7. PERFORMANCE PREMISES FOR HUMAN RESOURCES FROM PUBLIC HEALTH ORGANIZATIONS IN ROMANIA

8. The name is absent

9. The name is absent

10. Population ageing, taxation, pensions and health costs, CHERE Working Paper 2007/10