United Kingdom

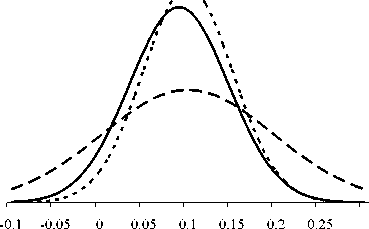

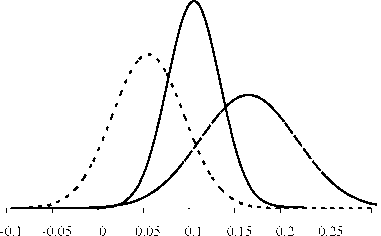

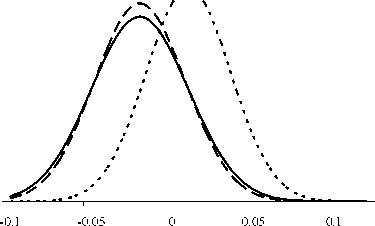

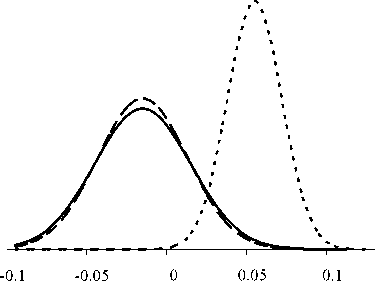

Figure 2.2 (continued)

Sweden

United States

Japan

2.6 Conclusion

This chapter analyses the sustainability of EU15 public finances in line with the recent

literature on fiscal reaction functions. According to this approach a positive response of

the primary surplus to debt accumulation is sufficient for sustainability in a wide range of

dynamic stochastic general equilibrium models, thus providing a rather general condition

for testing the sustainability of fiscal policy.

Our baseline fiscal reaction function specification assumes that the primary surplus

responds to debt accumulation and to the output gap, and also incorporates the lagged

surplus to capture fiscal inertia. The estimation of this baseline model for the sample

period 1977-2005 suggests that a positive response to debt accumulation is quite

widespread, thus indicating that fiscal policy is sustainable in most countries.

A main concern of the chapter is the robustness of this result. Therefore, we consider

several alternatives to our baseline in order to investigate the potential existence of

simultaneity bias, the effect of including and excluding different explanatory variables,

and the effect of specifying a non-linear fiscal reaction function. The qualitative baseline

result is robust to these changes. We also explore the existence of structural breaks in the

45

More intriguing information

1. Improvements in medical care and technology and reductions in traffic-related fatalities in Great Britain2. Spatial Aggregation and Weather Risk Management

3. Do imputed education histories provide satisfactory results in fertility analysis in the Western German context?

4. FOREIGN AGRICULTURAL SERVICE PROGRAMS AND FOREIGN RELATIONS

5. Bidding for Envy-Freeness: A Procedural Approach to n-Player Fair Division Problems

6. Asymmetric transfer of the dynamic motion aftereffect between first- and second-order cues and among different second-order cues

7. Experience, Innovation and Productivity - Empirical Evidence from Italy's Slowdown

8. Stable Distributions

9. EFFICIENCY LOSS AND TRADABLE PERMITS

10. The name is absent