One could argue that showing the government’s future funding shortfall in terms of total

receipt and outlay time series would capture such a policy change as an upward shift in

both series. However, other policies could be implemented that would maintain both the

projected levels of revenues and expenditures and the gap between them (annual deficits),

yet exert real economic effects by redistributing resource across generations. Consider

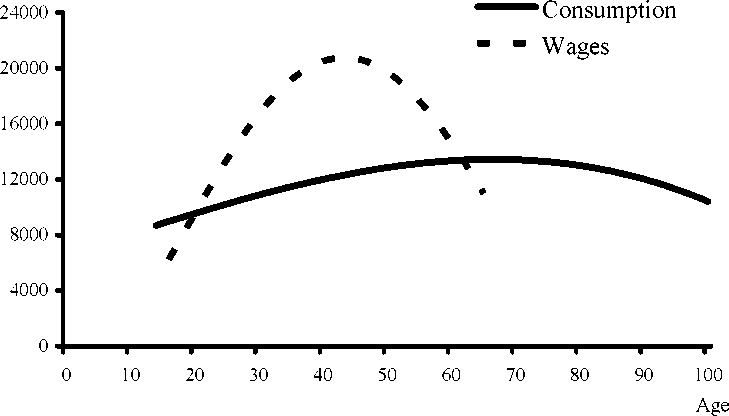

Figure 3.3, which shows stylized profiles by age of payroll tax and consumption tax

payments. Because the consumption tax profile is flatter and extends across older

individuals, a permanent pay-as-you-go structural tax change - that is, an annually

revenue-neutral switch from consumption to labour income taxes - time would

accomplish a sizable redistribution of tax burdens and wealth across generations.

Figure 3.3 Consumption and Wage Profile by Age

Euros/Year

As in the case of the pay-as-you-go expansion of public pensions, this policy also

provides a windfall benefit to current older generations but reduces the lifetime resources

of younger and future generations.25 However, such a policy change would be invisible to

Figure 3.1’s fiscal measure - the time series of projected revenues, expenditures, and

deficits. If propensities to consume out of resources of older generations are different

(say, higher) than those of younger generations, permanent redistributive policy changes

of this type would very likely exert real economic effects - affecting saving, capital

formation, interest rates, and eventually inflation and exchange rates.

The above discussion suggests that when policymakers enact diverse fiscal changes

designed to alter the time profiles of expenditures and revenues to reduce short-term

deficits, only some of those policies may be reflected in traditional cash-flow measures

Generally, a reduction of consumption taxes would make all existing assets more valuable because

the consumption financed through their sale would now face a lower tax rate. Much of the immediate

increase in asset values arising from this policy would benefit existing older generations who hold

most of the country’s wealth.

68

More intriguing information

1. Income Mobility of Owners of Small Businesses when Boundaries between Occupations are Vague2. Federal Tax-Transfer Policy and Intergovernmental Pre-Commitment

3. Do imputed education histories provide satisfactory results in fertility analysis in the Western German context?

4. Placentophagia in Nonpregnant Nulliparous Mice: A Genetic Investigation1

5. Review of “From Political Economy to Economics: Method, the Social and Historical Evolution of Economic Theory”

6. Performance - Complexity Comparison of Receivers for a LTE MIMO–OFDM System

7. The name is absent

8. The Dynamic Cost of the Draft

9. A Dynamic Model of Conflict and Cooperation

10. A Brief Introduction to the Guidance Theory of Representation