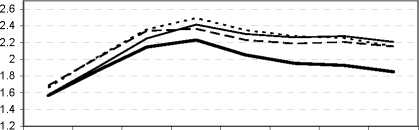

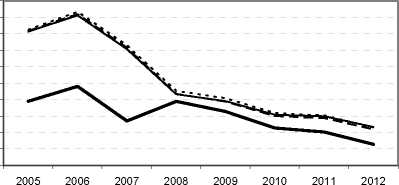

Real GDP growth

2005 2006 2007 2008 2009 2010 2011 2012

cuts in social contrib. ^^^“baseline

unchanged real govt. expend. — — — unchanged struct. bal.

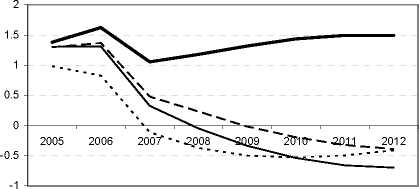

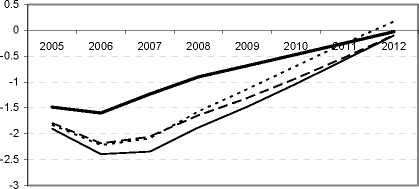

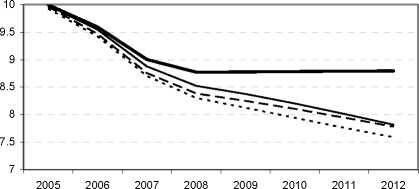

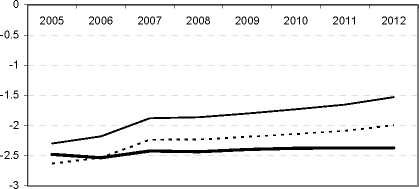

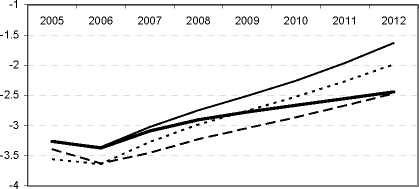

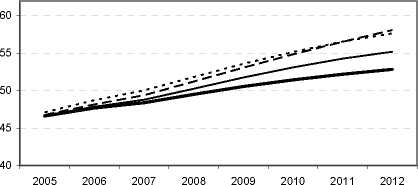

Figure 10. Simulated impact of a reduction of the NAIRU in a large euro country (France) under alterative fiscal

assumptions

Inflation

Output GAP

Unemployment rate

2.5

2.4

2.3

2.2

2.1

2

1.9

1.8

1.7

1.6

1.5

Potential output growth

Structural fiscal balance (% of GDP)

Fiscal balance (% of GDP)

Net government debt (% of GDP)

Note: The Nairu is assumed to fall progressively by 1.5 percentage points in the first three years of the simulation.

Nominal exchange rate kept unchanged relative to baseline. Real interest rates at the euro level are maintained

unchanged relative to baseline.

55. The econometric exercise in this paper provides additional evidence that the budgetary cost of

structural reform has been rather limited, whereas the longer-term benefits are significant. Probably nobody

would contest this general finding, but it is useful to be able to put some numbers on it. They broadly

concur with similar findings by Deroose and Turrini (2005), although they focus on the fiscal position

rather than on public expenditure. Obviously these findings are ex post and they may not apply to the

66

More intriguing information

1. RETAIL SALES: DO THEY MEAN REDUCED EXPENDITURES? GERMAN GROCERY EVIDENCE2. The name is absent

3. The name is absent

4. Review of “The Hesitant Hand: Taming Self-Interest in the History of Economic Ideas”

5. The name is absent

6. Sectoral specialisation in the EU a macroeconomic perspective

7. Transport system as an element of sustainable economic growth in the tourist region

8. The name is absent

9. CGE modelling of the resources boom in Indonesia and Australia using TERM

10. Needing to be ‘in the know’: strategies of subordination used by 10-11 year old school boys