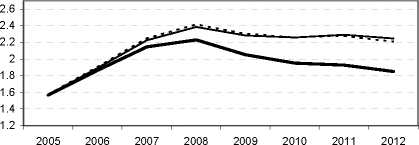

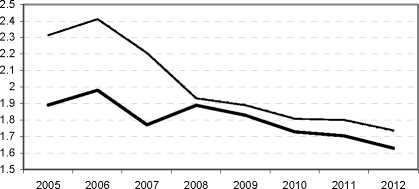

Real GDP growth

unchanged nom. int. rates ^^^“baseline

.....unchanged real euro rates

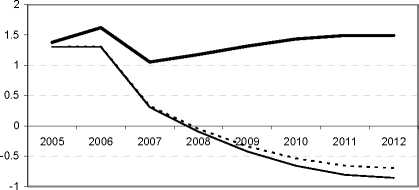

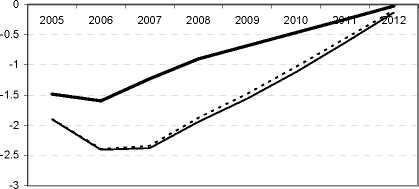

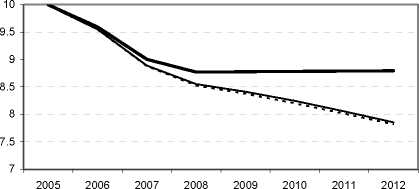

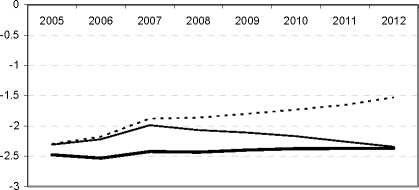

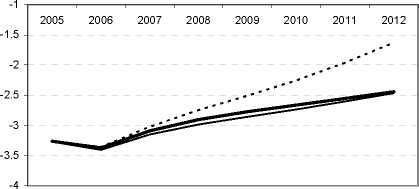

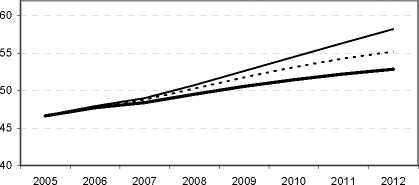

Figure 9. Simulated impact of a reduction of the NAIRU in a large euro area country (France) under alternative

monetary assumptions

Inflation

Output GAP

Unemployment rate

Potential output growth

Structural fiscal balance (% of GDP)

Fiscal balance (% of GDP)

Net government debt (% of GDP)

Note: The Nairu is assumed to fall progressively by 1.5 percentage points in the first three years of the simulation.

Nominal exchange rate kept unchanged relative to baseline. Real government expenditure is also kept

unchanged at baseline level.

64

More intriguing information

1. Income Growth and Mobility of Rural Households in Kenya: Role of Education and Historical Patterns in Poverty Reduction2. Cyber-pharmacies and emerging concerns on marketing drugs Online

3. The name is absent

4. The name is absent

5. Subduing High Inflation in Romania. How to Better Monetary and Exchange Rate Mechanisms?

6. The quick and the dead: when reaction beats intention

7. The name is absent

8. CHANGING PRICES, CHANGING CIGARETTE CONSUMPTION

9. Dual Track Reforms: With and Without Losers

10. Weak and strong sustainability indicators, and regional environmental resources