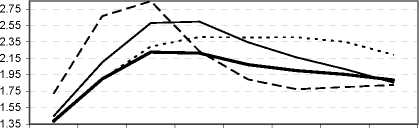

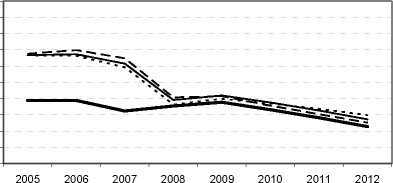

Real GDP growth

2005 2006 2007 2008 2009 2010 2011 2012

.....unchanged nominal inter. rates ^^^βbaseline

unchanged real inter. rates---fall in real inter. rates

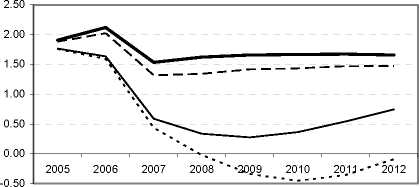

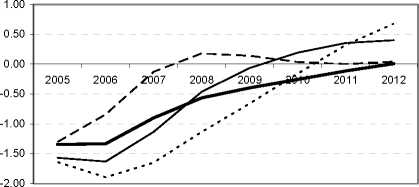

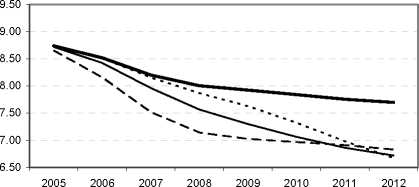

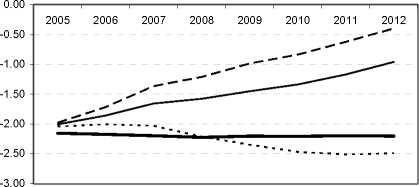

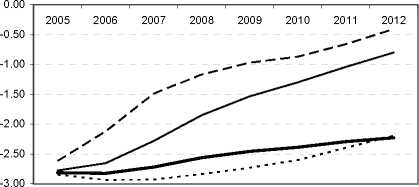

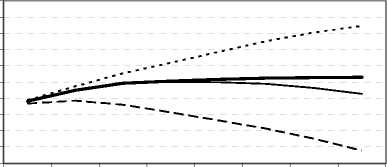

Figure 7. Stimulated impact of a reduction of the NAITU in the euro area under alternative monetary

assumptions

Inflation

Output GAP

Unemployment rate

2.50

2.40

2.30

2.20

2.10

2.00

1.90

1.80

1.70

1.60

1.50

Potential output growth

Structural fiscal balance (% of GDP)

Fiscal balance (% of GDP)

Net government debt (% of GDP)

2005 2006 2007 2008 2009 2010 2011 2012

Note: The Nairu is assumed to fall progressively by 1 percentage point in the first three years of the stimulation.

Nominal exchange rate are kept unchanged relative to baseline in the case of the simulations with fixed nominal

or fixed real interest rates relative to baseline. A flexible exchange rate assumption is retained for the simulation

with a fall in real interest rate. Real government expenditure is kept unchanged at baseline level.

Structural reform in a single country in monetary union

47. In the previous set of simulations it was assumed that all countries embark on structural reform

simultaneously. However, this may not occur in reality, which raises the issue whether the incentives for (or

reward of) structural reform is sufficiently strong for individual countries. There may also be a divide

61

More intriguing information

1. A Bayesian approach to analyze regional elasticities2. The name is absent

3. Gender and headship in the twenty-first century

4. Placenta ingestion by rats enhances y- and n-opioid antinociception, but suppresses A-opioid antinociception

5. The name is absent

6. Strengthening civil society from the outside? Donor driven consultation and participation processes in Poverty Reduction Strategies (PRSP): the Bolivian case

7. The name is absent

8. THE CO-EVOLUTION OF MATTER AND CONSCIOUSNESS1

9. Spectral density bandwith choice and prewightening in the estimation of heteroskadasticity and autocorrelation consistent covariance matrices in panel data models

10. The name is absent