Reriew of Islamic Economics, Vol. 8, No. 2.,' 1004

19

transformation of its financial system, to observe Islamic injunctions

in the conducting of business after the year 1989. This has put, as the

authors say, the spotlight on the performance of Islamic banks in

Sudan, and lends significance to their effort. The study employs the

SFA cost frontier approach, decomposing the error term ε into random

noise V and possible inefficiency factor u. The model specifications are

almost flawless.'9

The paper finds that the Islamic banks in Sudan have low X-

efficiency - technical and allocative - they were not optimizing their

input usage. Furthermore, the authors claim that inefficiency is more

in resource allocation than in their technical use. Based on these broad

findings, the study ventures a few policy prescriptions for improving

the performance of Islamic banks in Sudan. This sketch hopefully

does justice to their work.

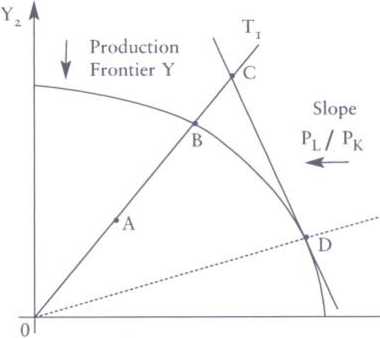

Figure 3: Output-Oriented Technical and Allocative Efficiency

Efficiency

Measures

TE=OAZOB

RE=OzVOD

AE=RFTTE

=OB∕OD

The effort of the authors is laudable as far as it goes. The

difficulty is that it does not go far enough, nor always stay on course.

It could have been prefaced with the details, even if brief, of the

evolution, expansion, transformation, and ownership or scale

structures of Islamic banks in Sudan. Is it that no foreign banks

operate in the country or interest-based financing is at zero level

More intriguing information

1. The name is absent2. Credit Market Competition and Capital Regulation

3. Non-farm businesses local economic integration level: the case of six Portuguese small and medium-sized Markettowns• - a sector approach

4. The name is absent

5. How much do Educational Outcomes Matter in OECD Countries?

6. On Dictatorship, Economic Development and Stability

7. MICROWORLDS BASED ON LINEAR EQUATION SYSTEMS: A NEW APPROACH TO COMPLEX PROBLEM SOLVING AND EXPERIMENTAL RESULTS

8. Consumer Networks and Firm Reputation: A First Experimental Investigation

9. Luce Irigaray and divine matter

10. The Triangular Relationship between the Commission, NRAs and National Courts Revisited