so that changes in the price of imported intermediate goods relative to labour

costs will result in a substitution between labour and intermediate import goods.

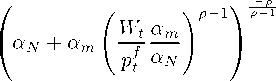

This can then be substituted back into the production function to obtain,

and,

N(z)t = (y(z)t)ψ

ρ-1

(11)

m(z)tf = (y(z)t)ψ

Wt am

ptf αN

1-ρ

We can next consider the definition of marginal cost for firm z ,

MC(z)t =

Wt ∂N(z)t pf ∂m(z)f

Pt ∂y(z)t + Pt ∂y(z)t

(12)

(13)

and after substituting for dN(z)t and dm(z)t

(from equations 11 and 12) we can

∂y(z)t ∂y(z)t

decompose marginal cost into two elements - one which is independent of the

firms actions and the other which depends upon the position they are operating

on their production function, such that marginal cost equals,

MC(z)t

(y(z)t)ψ-1

Wt fr^r+ α [ Wt am V 1V

Pt ^aN + am∖pff a.N ) J

+pf μa.τ(Wtamv-p+a ʌ

+ Pt ^aHιpf aN J + amJ

(14)

(y(z)t)ψ-1MgCt.

The first multiplicative term captures the increase in firm specific marginal costs

through increasing production given the fixed stock of capital3 and decreasing

marginal returns to the remaining factors. The second element reflects the

labour and intermediate goods costs that enter into the costs of production and

are constant across firms. We label this second term, MCt .

2.3 Profit Maximising Price Setting

We can now start to consider the problem facing a firm which chooses to set

its price in order to maximise profits. The real variable profits4 (deflated by

3 An alternative modelling strategy would be to allow capital to be reallocated across firms

so as to equate the shadow value of capital, implying that each firm’s marginal cost is identical

to the economy-wide average cost (see Sbordone (2002) for a discussion). However, the pos-

sibility that firms can reallocate capital without friction, but cannot reset prices continuously

seems implausible.

4 We ignore the fixed costs of utilising the capital stock in formulating the firm’s problem

and we assume that all shocks are sufficiently small that firms continue to earn positive profits

at all points in time.

More intriguing information

1. The Role of State Trading Enterprises and Their Impact on Agricultural Development and Economic Growth in Developing Countries2. The Composition of Government Spending and the Real Exchange Rate

3. The name is absent

4. What Drives the Productive Efficiency of a Firm?: The Importance of Industry, Location, R&D, and Size

5. The name is absent

6. The name is absent

7. Restricted Export Flexibility and Risk Management with Options and Futures

8. Fertility in Developing Countries

9. Evolution of cognitive function via redeployment of brain areas

10. Prevalence of exclusive breastfeeding and its determinants in first 6 months of life: A prospective study