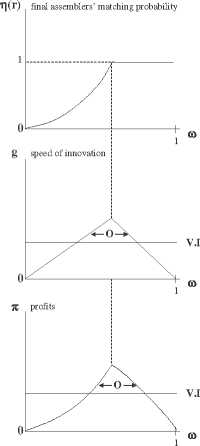

Figure 2: Intermediate Supplier Bargaining Power

Figure 2:

faster pace of innovation than vertical integration when the bargaining weight of suppliers takes

intermediate values. In particular, the supplier weight that yields the maximum speed of innovation

is the critical ω that just sets r in (24) equal to one:

* km

(31)

ω = —7-----;-----∙

ks (1 - a) + km

For ω = ω*, the same number of suppliers and assemblers enter the market (m = s), so search costs

are minimized as both groups are certain of being matched. In other words, in the search process

the negative intra-group externalities exactly offset the positive inter-group externalities. For higher

ω > ω*, we have r > 1 and thus η (r) = 1. Accordingly, a higher bargaining weight has no impact

on the matching probability of final assemblers leaving only a negative effect on their returns, their

incentives to enter, and hence innovation. The critical value ω* is increasing in a and decreasing

in ks∣km: a larger bargaining weight of suppliers is needed to compensate the stronger incentive to

enter final assemblers have when product differentiation rises and their relative entry costs fall.

The bottom panel in Figure 2 compares the profitability of vertical integration with that of

outsourcing showing that the latter is preferred by firms in the region of ω such that the number

18

More intriguing information

1. PROTECTING CONTRACT GROWERS OF BROILER CHICKEN INDUSTRY2. Structural Conservation Practices in U.S. Corn Production: Evidence on Environmental Stewardship by Program Participants and Non-Participants

3. AN EXPLORATION OF THE NEED FOR AND COST OF SELECTED TRADE FACILITATION MEASURES IN ASIA AND THE PACIFIC IN THE CONTEXT OF THE WTO NEGOTIATIONS

4. Tastes, castes, and culture: The influence of society on preferences

5. The name is absent

6. Towards a Strategy for Improving Agricultural Inputs Markets in Africa

7. The name is absent

8. Foreword: Special Issue on Invasive Species

9. Empirical Calibration of a Least-Cost Conservation Reserve Program

10. MATHEMATICS AS AN EXACT AND PRECISE LANGUAGE OF NATURE