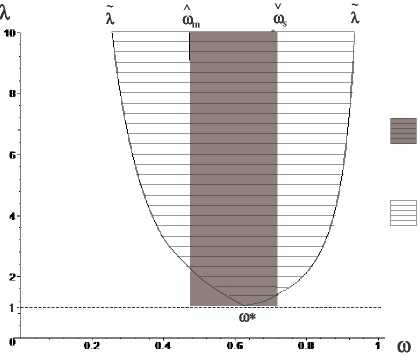

Figure 3: Dynamic Effects of Outsourcing on Innovation

Outsourcing

innovation

Outsourcing

chosen and faster

innovation

L=10; ρ=0.01; α=0.4; km=1; ks=1; kv=2.1;

Figure 3:

outsource generates slower innovation than vertical integration.

We can conclude that outsourcing is chosen by firms and encourages innovation when there are

substantial gains from specialization (large λ) and the ex post bargaining weights of intermediate

suppliers and final producers tend to reflect the relative incentives of labs to create the correspond-

ing blueprints (ω close to ω*). When this is the case, search and hold-up frictions are minimized.

Thus, by (31), in sectors in which the R&D costs of intermediate blueprints are large (resp. small)

with respect to the R&D cost of final blueprints, outsourcing is likely to accelerate innovation when

the bargaining weight of intermediate suppliers is also large (resp. small) with respect to the bar-

gaining weight of final assemblers. These results are amplified in sectors with pronounced product

differentiation.

5 Conclusion

We have proposed a model of horizontal product innovation with outsourcing to explore the im-

plications of fragmented production for innovation. The model focuses on situations in which the

fragmentation of production leads to complementary innovations by upstream and downstream labs

20

More intriguing information

1. The name is absent2. Une nouvelle vision de l'économie (The knowledge society: a new approach of the economy)

3. CHANGING PRICES, CHANGING CIGARETTE CONSUMPTION

4. Asymmetric transfer of the dynamic motion aftereffect between first- and second-order cues and among different second-order cues

5. Structural Conservation Practices in U.S. Corn Production: Evidence on Environmental Stewardship by Program Participants and Non-Participants

6. Improving Business Cycle Forecasts’ Accuracy - What Can We Learn from Past Errors?

7. A Consistent Nonparametric Test for Causality in Quantile

8. The name is absent

9. he Virtual Playground: an Educational Virtual Reality Environment for Evaluating Interactivity and Conceptual Learning

10. The name is absent