3 Investment, credit and output growth - a VAR analysis

clearly be better, but jointly, they give a more complete picture of the link between financial

development and growth.

Generalized impulse response functions

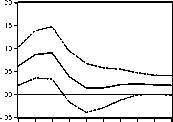

Figure 2 reports the generalized impulse responses from our first VAR that includes the

variables net domestic product, investment and bank lending. Our main interest is in the

effect that banks have on the net domestic product, which is displayed in Panel A. There,

a statistically significant effect for about four years exists. Panel B shows that there is in

addition another indirect effect. For a period of three to four years, an unexpected increase in

bank lending increases investment. It is well known that investment, in turn, has a positive

• л’тлтл 1 9

impact on NDP.12

Figure 2: Generalized Impulse Responses for Net Domestic Product, Investment and Bank Lending

1 2 3 4 5 6 7 8 9 10

|

Panel A |

________________________Panel B_________________________ | |

|

— |

Reaction of NDP |

Reaction of I |

|

_ |

___to a shock in B__________________ |

to shock in B |

Note: The solid lines trace the impulse responses of net domestic product

(NDP) to shocks in investment (I) and bank lending (B) for the years 1870

to 1912.

Table 3: Variance Decomposition for Net Domestic Product, Investment and Bank Lending

л r

Years

Variance Decomposition 5 10

NDP variance due to B (in percent) 24.009 23.129

[12.374] [12.294]

I variance due to B (in percent) 30.006 29.281

_____________________________________________[12.470] [12.541]

Note: The variance decomposition of the forecast error is

shown for the three-variable VAR, including net domestic

product (NDP), investment (I) and bank lending (B) for the

years 1870 to 1912. The values in parentheses indicate the

standard deviation.

Although the impulse response functions have revealed a clear link between aggregate bank

credit and net domestic product, they do not allow to assess the importance of these shocks

12Indeed, the impulse response for NDP and investment reveal a positive but short-lived impact on NDP, when

investment is shocked unexpectedly. Because this effect is often reported in the literature, we do not show

this graph in this paper.

More intriguing information

1. Are combination forecasts of S&P 500 volatility statistically superior?2. The name is absent

3. FOREIGN AGRICULTURAL SERVICE PROGRAMS AND FOREIGN RELATIONS

4. Innovation and business performance - a provisional multi-regional analysis

5. The name is absent

6. On the estimation of hospital cost: the approach

7. Regulation of the Electricity Industry in Bolivia: Its Impact on Access to the Poor, Prices and Quality

8. An Incentive System for Salmonella Control in the Pork Supply Chain

9. The name is absent

10. Dynamiques des Entreprises Agroalimentaires (EAA) du Languedoc-Roussillon : évolutions 1998-2003. Programme de recherche PSDR 2001-2006 financé par l'Inra et la Région Languedoc-Roussillon