Y1 = Y2

H 0: <λ = λ.

μ1 μ2

The third step forward considers the formation of the groups as endogenous. The idea is that firms

introduce innovations because they are more productive, young or intensive at investing into R&D

activities or innovative capital, or maybe because they have more cash flows. The age profile of the

board members and/or the share of temporary workers might be correlated to the innovativeness of

the firms as well.

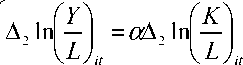

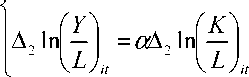

The new specification for labor productivity growth can be thought of as a standard case of

switching regression model with endogenous switching (as explained firstly in Maddala 1983). We

want to consistently estimate the parameters in two regimes: whether firms are innovative (regime j

= 1) or non innovative (regime j = 2) over the period of observation. The new model specification is

the following.

(ТетрогагУ

-----------I + ε1it if innovative

L √ it-2

(6)

(Temporary . ð

I + ε2it if noninnovativ

L √ it-2

The marginal distribution of the error terms εjit j=1,2 can be assumed normal with zero mean and

constant variance σj2. We shall modify this strong assumption in the robustness estimations. The

conditional distribution of the error terms are instead different from zero, according to:

Ε(ε1it | innovative) ≠ 0

(6’)

Ε(ε2it | non innovative) ≠ 0

This is because a criterion function determines whether a firm belongs to regime 1 or 2, as in

equation (7):6

'D1 = 1 if δZit + ωit > 0

1

(7)

D1 = 0 otherwise

6 D1 = 0 ⇔ D2 = 1 , meaning that, if a firm has not introduced an innovation in 2001-2003, it is non innovative by

definition.

11

More intriguing information

1. EU enlargement and environmental policy2. The name is absent

3. Improving the Impact of Market Reform on Agricultural Productivity in Africa: How Institutional Design Makes a Difference

4. The name is absent

5. Land Police in Mozambique: Future Perspectives

6. DISCRIMINATORY APPROACH TO AUDITORY STIMULI IN GUINEA FOWL (NUMIDA MELEAGRIS) AFTER HYPERSTRIATAL∕HIPPOCAMP- AL BRAIN DAMAGE

7. A MARKOVIAN APPROXIMATED SOLUTION TO A PORTFOLIO MANAGEMENT PROBLEM

8. The name is absent

9. Effects of a Sport Education Intervention on Students’ Motivational Responses in Physical Education

10. NATURAL RESOURCE SUPPLY CONSTRAINTS AND REGIONAL ECONOMIC ANALYSIS: A COMPUTABLE GENERAL EQUILIBRIUM APPROACH