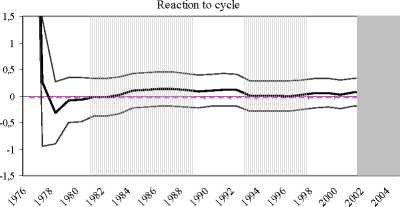

Figure 4.7 Results for the Primary Expenditures

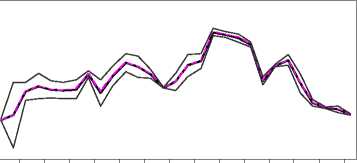

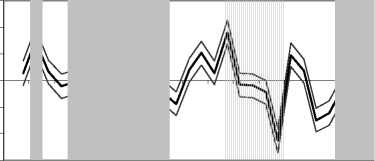

Budget balances: actual and "core"

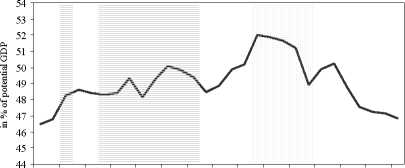

54 1

53 -

52 -

51 -

50 -

49 -

48 -

47 -

46 -

45 -

44 -

core balance: nu----actual balance core balance ±1.96*std

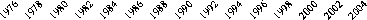

—— reaction to cycle: gamma----EC automatic stabɪlzer: alpha --------reaction to cycle ±196*std -------

Budget balances: "core" and cyclically adjusted

"Core" discretionary policy

core balance: nu EC cyclically adj.balance (based on potential GDP) ∣

core discretionary policy: eta core discretionary policy ±1.96*std ∣

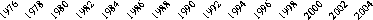

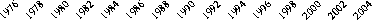

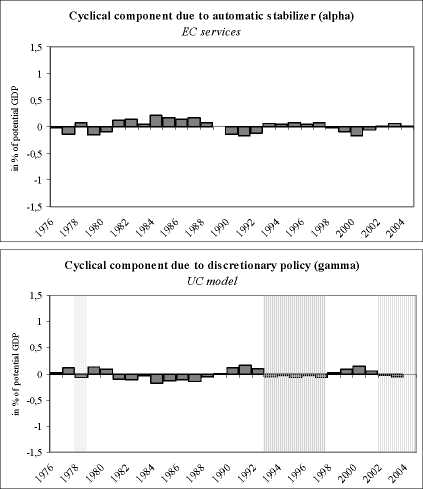

Figure 4.8 Decomposition of the Primary Expenditures

Core component (nu)

UC model

Irregular component (epsilon)

UC model

-1,5

1,5

1

0,5

0

£ -0,5

-S

-1

On the expenditure side, the relatively minor impact of the automatic stabilisers related to

the unemployment transfers seems to be completely neutralised62 (see Figures 4.7 and

4.8).

Next we check for an asymmetric cyclical behaviour in downturns and upturns, i.e. taking

the cyclically adjusted (primary) budget balance as dependent variable and looking for

However, if the dependent variables are taken as ratios of the nominal GDP instead of potential

nominal GDP we get a pronounced pro-cyclicality of the cyclically adjusted revenues and a

pronounced counter-cyclicality of the cyclicality adjusted expenditures.

112

More intriguing information

1. The Values and Character Dispositions of 14-16 Year Olds in the Hodge Hill Constituency2. The name is absent

3. Wounds and reinscriptions: schools, sexualities and performative subjects

4. Voluntary Teaming and Effort

5. SLA RESEARCH ON SELF-DIRECTION: THEORETICAL AND PRACTICAL ISSUES

6. The name is absent

7. EMU's Decentralized System of Fiscal Policy

8. A Note on Productivity Change in European Co-operative Banks: The Luenberger Indicator Approach

9. PER UNIT COSTS TO OWN AND OPERATE FARM MACHINERY

10. THE CO-EVOLUTION OF MATTER AND CONSCIOUSNESS1