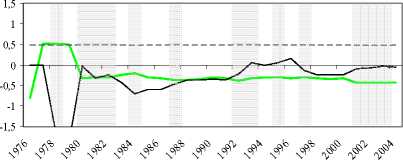

the discretionary fiscal policy impact in upturns (periods in which the real growth rate is

above the potential growth rate) and downturns (periods in which the real growth rate is

below the potential growth rate). It appears that in upturns a strong pro-cyclical

discretionary policy impact dominates (however, the γ coefficient is slightly smaller than

the overall budget sensitivity estimated by the OECD for Austria),63 whereas the pro-

cyclical impact in downturns turns out to be negligible. Hence, we can conclude that in

Austria overall fiscal policy in downturns is counter-cyclical, whereas in upturns the

working of automatic stabilisers is neutralised (see Figure 4.9). This is in principle in line

with general findings based on panel regressions for OECD countries (such as those by

OECD (2003), Balassone et al. (2004) or Forni and Momigliano (2004); these papers

provide evidence for counter-cyclical behaviour in downturns and - at least the first two

studies - pro-cyclicality in upturns.)

Results for the Total Balance

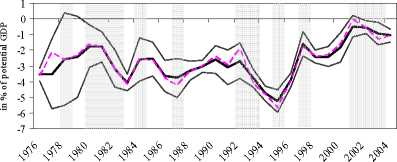

Figure 4.9

Budget balances: actual and "core'

•core balance: nu — — — - actual balance — core balance ±1.96*std

Reaction to cycle

reaction to cycle: gamma upturn ----------reaction to cycle: gamma downturn EC automatic stabillzer: alpha

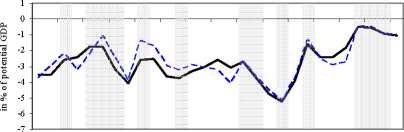

Budget balances: "core" and cyclically adjusted

• core balance: nu----EC cyclically adj.balance (based on potential GDP)

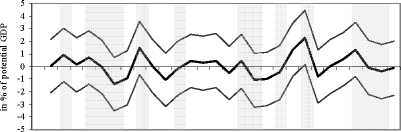

"Core" discretionary policy

■ core discretionary policy: eta core discretionary policy ±1.96*std ∣

Finally we focus on the evolution of the core balances. Compared to the cyclically

adjusted budget balances the core balances exhibits slightly less variability.

As mentioned in the introduction, the variability of these reflect discretionary measures

not related to the cycle, such as permanent consolidation measures, measures aiming at

distributional and allocative/structural goals or effects of macroeconomic shocks,

demographic changes, etc. Thus Figure 4.10 depicts major episodes of fiscal

consolidation on the one hand and the introduction of expenditure measures aiming at

further improving the Austrian welfare state on the other hand, as well as the impact of

structural changes in the Austrian economy.

For example, in 1984 Austria implemented a sizeable consolidation package, including

the increase of the VAT rate and other indirect taxes as well as the contribution rate of the

unemployment insurance scheme. Another big consolidation package was implemented

However, the coefficient is of the same size as the overall budget sensitivity calculated by the OeNB.

Taking the OeNB’s value of the overall budget sensitivity would lead to the conclusion that the

impact of the automatic stabilizers is completely neutralized in upturns.

113

More intriguing information

1. The Interest Rate-Exchange Rate Link in the Mexican Float2. PROFITABILITY OF ALFALFA HAY STORAGE USING PROBABILITIES: AN EXTENSION APPROACH

3. Spatial patterns in intermunicipal Danish commuting

4. Reversal of Fortune: Macroeconomic Policy, International Finance, and Banking in Japan

5. The name is absent

6. Skills, Partnerships and Tenancy in Sri Lankan Rice Farms

7. Whatever happened to competition in space agency procurement? The case of NASA

8. DEMAND FOR MEAT AND FISH PRODUCTS IN KOREA

9. THE UNCERTAIN FUTURE OF THE MEXICAN MARKET FOR U.S. COTTON: IMPACT OF THE ELIMINATION OF TEXTILE AND CLOTHING QUOTAS

10. Estimated Open Economy New Keynesian Phillips Curves for the G7