used to smooth the financial burden, cf above.

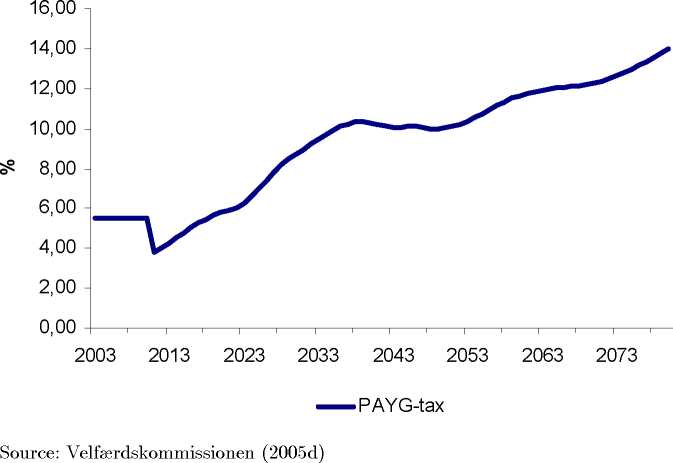

The upward trend in the dependency ratio causes an upward trend in the

tax rate on labour income which in the medium to long run becomes more

than twice the current level, cf. figure 4. Underlying the trend there are some

variations. Initially there is scope for some tax reduction but eventually the

demographic development requires an increasing tax rate.

Figure 4: PAYG-tax

5.2 The sustainable tax rate

Consider alternatively the once and for all change in the tax rate that ensures

fiscal sustainability, cf above. More specifically this gives the permanent change

in the tax rate which ensures that the intertemporal budget constraint for the

public sector is fulfilled.

The sustainable tax rate is 7.9 percentage points ab ove the current rate.

This shows two things. First, current welfare arrangements are not fiscally sus-

tainable despite current surpluses. Second, the needed reforms are substantial

since they should have budgetary consequences equivalent to an increase in the

base tax rate by 7.9 percentage points.

Since there is an underlying trend in the dependency ratio, it is an impli-

cation of the sustainable tax rate that it implies a substantial consolidation of

public finances. That is, it implies a pre-funding strategy (for a further dis-

cussion see Andersen, Pedersen and Houggard Jensen (2005))17 The primary

17 McKissack and Comley (2005) consider pre-funding strategies adopted in some OECD

16

More intriguing information

1. Globalization, Divergence and Stagnation2. Place of Work and Place of Residence: Informal Hiring Networks and Labor Market Outcomes

3. The name is absent

4. WP RR 17 - Industrial relations in the transport sector in the Netherlands

5. Influence of Mucilage Viscosity On The Globule Structure And Stability Of Certain Starch Emulsions

6. Discourse Patterns in First Language Use at Hcme and Second Language Learning at School: an Ethnographic Approach

7. Correlates of Alcoholic Blackout Experience

8. Cyclical Changes in Short-Run Earnings Mobility in Canada, 1982-1996

9. Non-causality in Bivariate Binary Panel Data

10. Segmentación en la era de la globalización: ¿Cómo encontrar un segmento nuevo de mercado?