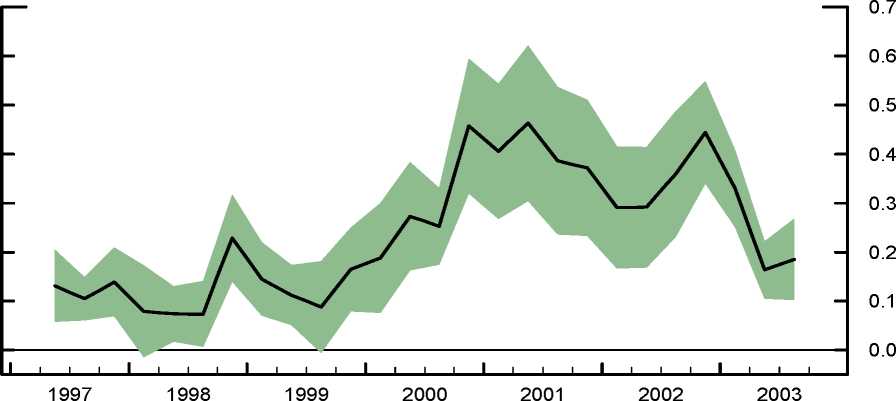

Figure 7

NLLS Estimates of Bankruptcy Cost Parameter μ

Note. The shaded region represents +/- two standard error bands computed using a

heteroscedasticity-consistent asymptotic covariance matrix.

liquidation costs calculated by Alderson and Betker (1995) for a sample of firms that

completed Chapter 11 bankruptcy proceedings between 1982 and 1993. In 2003, as

the economy recovered, stock prices started to rise, and credit spreads narrowed, the

point estimate of μ declined back to the range that prevailed at the beginning of our

sample period.

According to standard errors in Table 2, estimates of μ are not statistically dif-

ferent from zero at conventional significance levels in just two periods (1998Q1 and

1999Q3). In all other periods, we overwhelmingly reject the null hypothesis of no

financial market frictions. The benchmark specification also fits the data remark-

ably well, explaining as much as 88 percent of the cross-sectional variance in credit

spreads during our sample period. Likelihood ratio tests strongly reject the exclusion

of credit rating effects throughout the sample period, while industry effects are statis-

tically significant only in the aftermath of the Russian default in late 1998 and from

the end of 2000 forth. These results suggest that factors other than bankruptcy costs

and expected probabilities of default play an important role in determining spreads

on corporate bonds, especially during periods of heightened volatility in financial

markets.

24

More intriguing information

1. The name is absent2. The name is absent

3. Monetary Policy News and Exchange Rate Responses: Do Only Surprises Matter?

4. The name is absent

5. THE CHANGING RELATIONSHIP BETWEEN FEDERAL, STATE AND LOCAL GOVERNMENTS

6. Emissions Trading, Electricity Industry Restructuring and Investment in Pollution Abatement

7. SOME ISSUES CONCERNING SPECIFICATION AND INTERPRETATION OF OUTDOOR RECREATION DEMAND MODELS

8. The name is absent

9. The name is absent

10. The name is absent