2500

4000

3500

3000

50 100 150 200 250

-200

1200

50 100 150 200 250

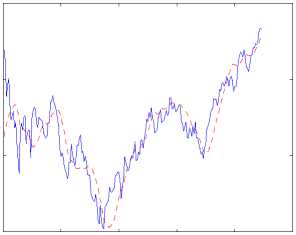

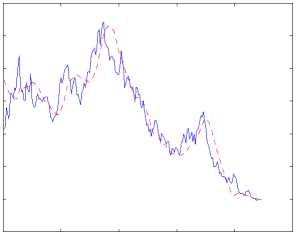

(a) Underlying asset: daily values during the last (b) Option: daily values during the last 223 days,

inria-00457222, version 1 - 16 Feb 2010

223 days, and trend (- -)

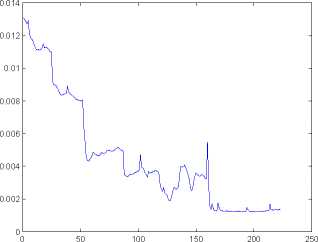

(c) Daily interest rate r

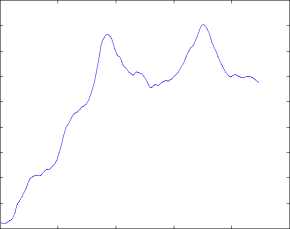

Figure 2: Example 1: CFU9PY3500

and trend (- -)

0 50 100 150 200 250

(d) ∆ tracking

[3] Black F., Scholes M., The pricing of options and corporate liabilities,

J. Political Economy, 3, 637-654, 1973.

[4] Cartier P., Perrin Y., Integration over finite sets, in Nonstandard

Analysis in Practice, F. & M. Diener (Eds), Springer, 1995, pp. 195-204.

[5] Cont R., Tankov P., Financial Modelling with Jump Processes, Chap-

man & Hall/CRC, 2004.

[6] Derman, E., Taleb N., The illusion of dynamic delta replication, Quan-

titative Finance, 5, 323-326, 2005.

[7] El Karoui N., Jeanbianc-Picque M., Shreve S., Robustness of the

Black and Scholes formula, Math. Finance, 8, 93-126, 1998.

[8] Fliess M., Join C., Commande sans mod`ele et commande a`

modèle restreint, e-STA, 5 (n° 4), 1-23, 2008, (available at

http://hal.inria.fr/inria-00288107/en/).

[9] Fliess M., Join C., A mathematical proof of the existence of trends in fi-

nancial time series, in Systems Theory: Modeling, Analysis and Control, A.

More intriguing information

1. The name is absent2. Disentangling the Sources of Pro-social Behavior in the Workplace: A Field Experiment

3. Non Linear Contracting and Endogenous Buyer Power between Manufacturers and Retailers: Empirical Evidence on Food Retailing in France

4. The name is absent

5. The name is absent

6. A Principal Components Approach to Cross-Section Dependence in Panels

7. The name is absent

8. Gender and headship in the twenty-first century

9. Globalization and the benefits of trade

10. Strategic Effects and Incentives in Multi-issue Bargaining Games