---CS (60,3) roll60

stderr

----p-val

---CS (120,3) roll60

stderr

----p-val

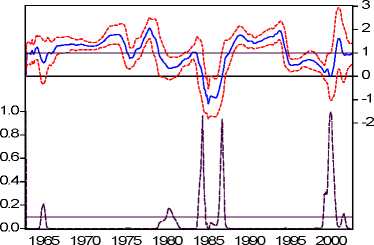

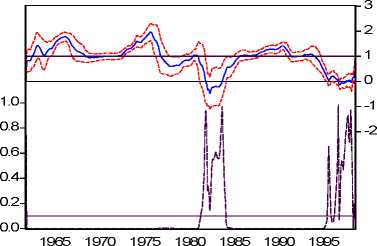

Figure 5

These results, coupled with the statistical tests performed in Section 4, suggest the presence of non

linearity in the empirical equation used to test the expectations hypothesis15. In particular, the slope

estimates tend to be statistically not significant when both the level and the volatility of term premia

are large16.

There is broad consensus on the role played by that time-varying term premia in explaining the

empirical failure of the expectation hypothesis (Fama, 1986; Cook and Hahn, 1989; Campbell,

1995; Lee, 1995; Tzavalis and Wickens, 1997). In the expectational model the term premia effect is

captured partially by the residual term and partially by the intercept of the model. Consequently, a

change in the level of term premia, due for instance to changing conditions of the economy, affects

the empirical assessment of the expectations theory; the term premia effect cause a shift in the

intercept of the model, which in turns generates a bias in the slope estimate; we thus suggest that

linear models are not appropriate to test the EH.

In order to deal with this evidence we suggest estimating the Campbell-Shiller equation with a

threshold model; hence, we allow the term premium to be, not only time-varying, but also regime-

dependent ( tpt, m (f ) ); in particular, regimes are determined by the value of the term premium as

shown below:

15 Equation (9) has been estimated in the entire sample (between 1964 and 2002); then we have performed the Chow

breakpoint test performed to check for structural breaks. The test has failed to reject the null hypothesis of absence of

structural break for the dates when the term premium displays highest local volatility. In addition, residuals obtained by

the OLS estimation of (9) are both serially correlated and heteroscedastic; the Newey and West correction help to deal

with this problem.

16 Mankiw and Miron (1986) point out that the uncertainty regarding the future path of interest rates can explain the

empirical failure of the expectations theory. In particular, they argue that the random walk behaviour of the short term

rate, due to the interest rate smoothing policy of the Federal Reserve, affect the predictability of short rates. They

identify the breakpoint with the creation of the Fed in 1914.

17

More intriguing information

1. The name is absent2. Do Decision Makers' Debt-risk Attitudes Affect the Agency Costs of Debt?

3. Real Exchange Rate Misalignment: Prelude to Crisis?

4. On the job rotation problem

5. The name is absent

6. KNOWLEDGE EVOLUTION

7. Imperfect competition and congestion in the City

8. Testing the Information Matrix Equality with Robust Estimators

9. The name is absent

10. Running head: CHILDREN'S ATTRIBUTIONS OF BELIEFS