CAPACITY AND ASYMMETRIES IN MONETARY POLICY

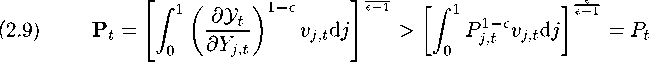

optimal production level of the final firm (Pt is indeterminate. However, when some

input is supply-constrained, the final good price is larger than the input price.

As a result, the spillover term (Fyt∕Pt) 6is larger than one. This term is going to

play a significant role in the model’s behavior, as will be stressed later.

2.2. Intermediate Good Firms. In this sector, each intermediate good is pro-

duced by a monopolistically competitive firm making use of capital and labor,

which are combined for production through a putty-clay technology. Intermediate

firms start period t with a predetermined level of capacity. Such a production plan

cannot be adapted to the needs of the firm within the period. Hence, investment

achieved during period t - 1 becomes productive at date t. Investment consists of

the design of a production plan by simultaneously choosing a quantity of capital

goods Kjtt and employment capacity Njtt according to the following Cobb-Douglas

technology:

(2.10) ‰ = AtK*tN⅛a

where 0 < a < 1. The term At is the aggregate productivity parameter, capturing

total factor productivity. The variable Njtt represents the maximum number of

available work-stations in the firm. Hence, the firm is at full capacity when all

these work-stations are operating full-time. As it is common in models featuring a

putty-clay technology, it is convenient to express investment decision as the choice

of both Kjtt and a capital-labor ratio Xjtt ≡ Kjtt∕Njtt. Consequently, the expression

in (2.10) can be rewritten as

(2-11) YjU = AtX^1Kju

from where the technical productivity of the installed equipments can be deduced.

For the case of capital, it is given by AtX°1^~1, whereas AtX“t represents that of

labor, so that this production function displays constant returns-to-scale in the

within-period labor. In particular, if the firm uses a quantity of labor Ldt smaller

than Njtt, it then produces AtXtjtLdt units of intermediate good. Once the id-

iosyncratic (demand) shock Vjtt is revealed, the firm instantaneously adjusts its

labor demand Ld t to cover the needs of its production plan, lyt, that is,

fel2∙ l∙'<=⅛ = ⅛ mi" {y∙t⅛∙ (¾) ∙ Ц ∙

In order to finance such productive activities, intermediate good firms must borrow

the necessary amount of money from a financial intermediary since cash earnings

do not arrive in time to finance the period wage bill. Specifically, firms rent labor

at a wage Wt which is paid with cash obtained from the financial intermediary at

an interest rate R1j > 0. At the end of the period, the firm pays back the loan and

the interests: ΠztF-t(l + Rt ).

After observing the aggregate shocks, but before knowing the idiosyncratic one,

input producing firms take their price decisions. Input prices are announced on

the basis of (rational) expectations, before the exact value of the demand for their

production is realized. This price-setting assumption has the advantage of giving

More intriguing information

1. Structural Influences on Participation Rates: A Canada-U.S. Comparison2. Target Acquisition in Multiscale Electronic Worlds

3. The name is absent

4. La mobilité de la main-d'œuvre en Europe : le rôle des caractéristiques individuelles et de l'hétérogénéité entre pays

5. Learning and Endogenous Business Cycles in a Standard Growth Model

6. The name is absent

7. Computing optimal sampling designs for two-stage studies

8. The name is absent

9. Heavy Hero or Digital Dummy: multimodal player-avatar relations in FINAL FANTASY 7

10. The name is absent