G-DAE Working Paper No. 03-01: “Read My Lips: More New Tax Cuts”

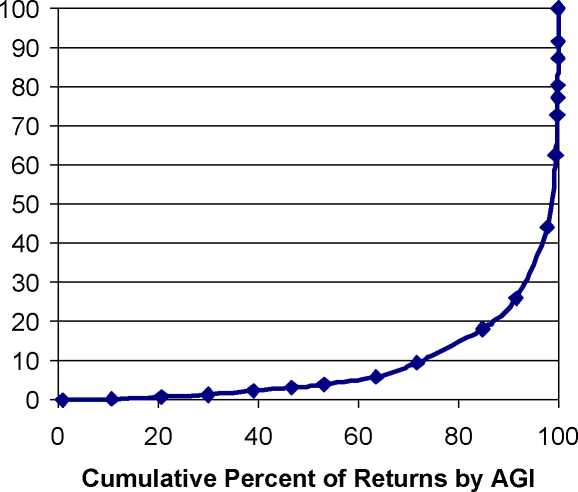

Figure 2. Estimated Distribution of Tax Savings from Repeal of Dividend Taxation,

by AGI

VII. Conclusions

This paper has examined the distributional benefits of the Bush administration’s proposal

to permanently eliminate dividend taxation received by individuals. The administration’s

claim that seniors receive the majority of dividend income is not supported by the

available data. It appears that the administration overstates the proportion of dividend

income that accrues to seniors by a factor of two. Additionally, the implication that the

primary beneficiaries of repealing dividend taxation are seniors who rely on dividend

income to get by is misleading. Most taxpayers receive no dividend income, particularly

those who are non-white, and would not benefit from a repeal of dividend taxation.

High-income taxpayers receive the majority of dividend income and would be the

primary beneficiaries of dividend tax repeal.

The distribution of the benefits of repealing dividend taxation is disproportional to the

distribution of dividend income. Thus, repealing dividend taxation would, ceteris

paribus, increase income inequality in the U.S. Currently, income inequality in the U.S.

is at a historic high.18 Also, the level of economic inequality in the U.S. exceeds that

18 The Changing Shape of the Nation’s Income Distribution, 1947-1998, U.S. Census Bureau report P60-

204, June 2000.

12

More intriguing information

1. Discourse Patterns in First Language Use at Hcme and Second Language Learning at School: an Ethnographic Approach2. How Offshoring Can Affect the Industries’ Skill Composition

3. Reputations, Market Structure, and the Choice of Quality Assurance Systems in the Food Industry

4. TOMOGRAPHIC IMAGE RECONSTRUCTION OF FAN-BEAM PROJECTIONS WITH EQUIDISTANT DETECTORS USING PARTIALLY CONNECTED NEURAL NETWORKS

5. The name is absent

6. Innovation Policy and the Economy, Volume 11

7. Auction Design without Commitment

8. Can a Robot Hear Music? Can a Robot Dance? Can a Robot Tell What it Knows or Intends to Do? Can it Feel Pride or Shame in Company?

9. The name is absent

10. The voluntary welfare associations in Germany: An overview