G-DAE Working Paper No. 03-01: “Read My Lips: More New Tax Cuts”

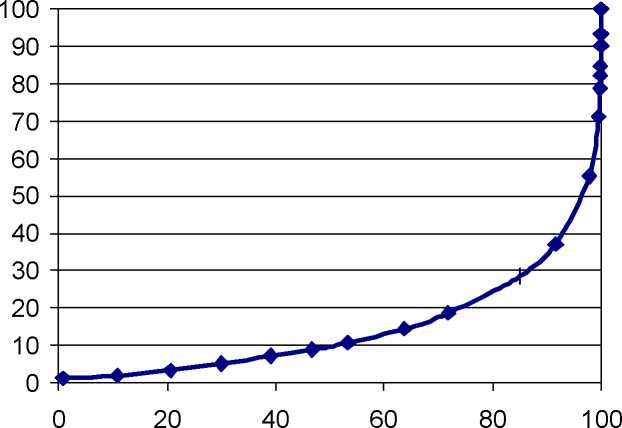

Figure 1. Distribution of 2000 Dividend Income, by AGI

Cumulative Percent of Returns by AGI

income, based on the distribution by AGI, is about 0.70.13 This is much more unequal

than the distribution of U.S. income as a whole, which is currently about 0.47.

IV. Benefits to Seniors from Repeal of Dividend Taxation

The President claims that seniors, nearly 10 million strong, would receive a

disproportionate share of the benefits from eliminating dividend taxes - an average

savings of nearly $1,000 each. We now examine these assertions. First, do 9.8 million

seniors currently receive dividend income? The Census Bureau data presented in Table 1

indicate that the number of people aged 65 and over who received dividend income in

1999 was only about seven million - 17% lower than the administration’s figure. A

couple of explanations could be suggested to explain the discrepancy. The administration

could be using more recent data showing that more seniors receive dividend income.

Also, the administration could be using a different definition of “seniors,” such as those

aged 60 or over.

Next, consider the administration’s claim that seniors with dividend income will receive

an average benefit of $936. An important point is the difference between the average

benefit and the benefits to the typical senior with dividend income. Given an unequal

13 Gini coefficient calculation made by assuming linearity between each data point. This creates a minor

downward bias in the calculation; the actual Gini coefficient based on dividend income would be slightly

higher.

More intriguing information

1. Portuguese Women in Science and Technology (S&T): Some Gender Features Behind MSc. and PhD. Achievement2. Multifunctionality of Agriculture: An Inquiry Into the Complementarity Between Landscape Preservation and Food Security

3. Multimedia as a Cognitive Tool

4. INTERPERSONAL RELATIONS AND GROUP PROCESSES

5. Plasmid-Encoded Multidrug Resistance of Salmonella typhi and some Enteric Bacteria in and around Kolkata, India: A Preliminary Study

6. The name is absent

7. Fiscal federalism and Fiscal Autonomy: Lessons for the UK from other Industrialised Countries

8. THE EFFECT OF MARKETING COOPERATIVES ON COST-REDUCING PROCESS INNOVATION ACTIVITY

9. Les freins culturels à l'adoption des IFRS en Europe : une analyse du cas français

10. GOVERNANÇA E MECANISMOS DE CONTROLE SOCIAL EM REDES ORGANIZACIONAIS