William Davidson Institute Working Paper 402

NBR main task of fighting inflation, given that, most of the time, all these credits

translated into a larger money supply.

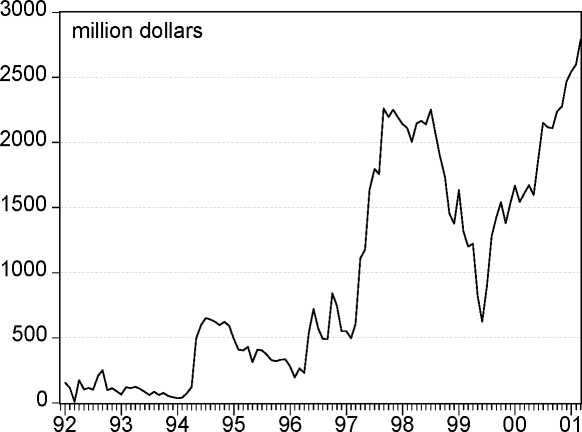

From Table 1 it can be seen that the most spectacular increase in NBR assets

refers to the net reserves of foreign exchange. After the 1999 mini-crisis, the central

bank bought large quantities of foreign currency and foreign currency denominated

assets. Today the stock of foreign reserves looks satisfactorily (Figure 7). The strategy

of buying dollars entailed a sharp increase in the monetary base and tested the ability

and willingness of the NBR to sterilise excess liquidity. Two factors pushed towards

this decision: on one hand, under IMF’ nudging, Romania aimed to recover a

“normal” stock of foreign reserves, to signal her credibility as an international

borrower. On the other hand, NBR officials considered that the leu nominal

depreciation was necessary in order to maintain export competitiveness. Both of these

motivations are sensible, although one may be more ambivalent about the relationship

between nominal depreciation and real depreciation in the high-inflation Romanian

context, and also about the impact of a weak leu on export competitiveness in the

long-run. It is also not very clear whether the speed of recovering the reserves was the

most appropriate. On one hand, given the available sterilisation instruments, such a

strong variation in NBR assets clearly brought about a huge increase in the monetary

base; this increase fuelled the money stock and prices, and caused policy slippage

which pushed inflation beyond its target. One can submit that a more gradual reserve

recovery would have reduced policy slippage and better tempered inflation. On the

other hand, in view of the recurrent emerging crises and the need to avert external

shocks, the central bank’s obsession with rebuilding its reserve stock at a rapid pace

did make sense.

Figure 7: Gross foreign assets with the NBR in US dollar equivalent. January

1992 to March 2001. Source: NBR Monthly Bulletins

7.4. Sterilization: NBR methods

When a central bank intervenes in the foreign exchange market and acquires

foreign currencies, it pushes towards (nominal) depreciation the domestic currency.

But the increase in the assets of the central bank comes with an equivalent increase in

its liabilities, more precisely of the reserves that ordinary banks held with the central

18

More intriguing information

1. Economic Evaluation of Positron Emission Tomography (PET) in Non Small Cell Lung Cancer (NSCLC), CHERE Working Paper 2007/62. DISCUSSION: POLICY CONSIDERATIONS OF EMERGING INFORMATION TECHNOLOGIES

3. Secondary stress in Brazilian Portuguese: the interplay between production and perception studies

4. The name is absent

5. The name is absent

6. The name is absent

7. The name is absent

8. Nurses' retention and hospital characteristics in New South Wales, CHERE Discussion Paper No 52

9. The name is absent

10. Uncertain Productivity Growth and the Choice between FDI and Export