William Davidson Institute Working Paper 402

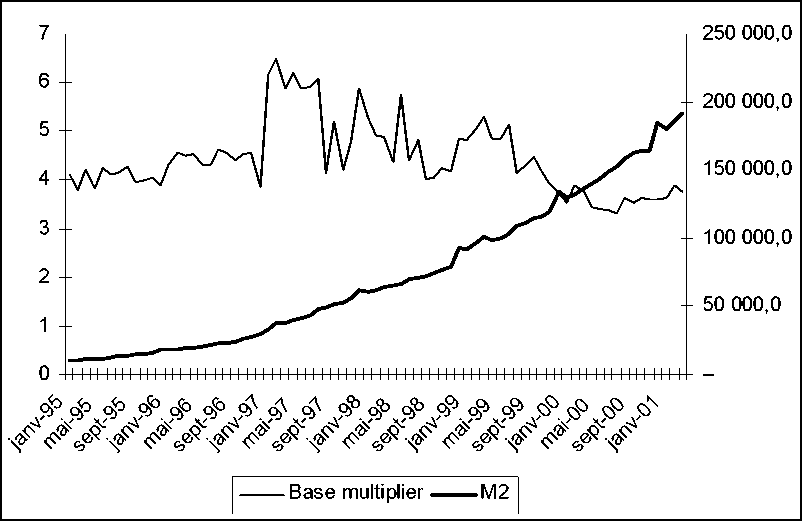

of-transition value of about 4.15 Clearly, the main responsible for increases in money

stock are increases in the monetary base.

Figure 4. Money stock and the base multiplier. January 1995 to March 2001.

M2 is expressed in billion lei, right hand axis. Source: NBR, Monthly Statistical

Bulletins.

7.2 The structure of the base multiplier

However, a deeper analysis of the multiplier could be useful. Let us consider

that commercial banks hold as reserves (deposits at the central bank) a proportion r<1

of their deposits in lei and a proportion ρ<1 of their dollar denominated deposits.

Banking regulation determines a minimum reserve requirement; in addition, banks in

the developed world would hold some limited amount of excess reserves if the

volatility of the flow of deposits were high.16 Private agents would hold cash in

proportion b to their lei deposits, in keeping with their payment habits. They would

also hold d lei in dollar denominated deposits for every leu deposit (we assume for

simplicity that people would not hold dollars cash, given that they cannot use it as

such for transaction purposes and that dollars notes carry no interest17).

Let us denote by D the lei deposits (to simplify, we make no difference

between demand, time and savings deposits). The money stock is M = Cash +Lei

deposits + $deposits = bD + D + dD = D(1 + b + d). The money base is: B = Cash +

Reserves = bD + rD + ρdD = D(r + b + ρd). The money multiplier is thus:

15 One may point at the exceptional conditions in 1997, when inflation was 151% and real money

supply plummeted; by comparison, 1997-1998 were like an intermezzo, to be followed by return to

what seems to be normality in Romania - a money multiplier of around 4.

16 Minimum reserves bear an interest rate fixed on a periodic base by the NBR (e.g, 25% on reserves

build for lei deposits in July 2001). Excess reserves are remunerated at a much lower rate (for

overnight deposits, the interest rate was 5% in July 2001).

17 In practice, firms and individuals would use hard currency in cash for certain transactions, even if

this is illegal. Transactions with VISA and other credit cards often are denominated directly in dollars.

15

More intriguing information

1. The name is absent2. Cryothermal Energy Ablation Of Cardiac Arrhythmias 2005: State Of The Art

3. Modeling industrial location decisions in U.S. counties

4. Short- and long-term experience in pulmonary vein segmental ostial ablation for paroxysmal atrial fibrillation*

5. On s-additive robust representation of convex risk measures for unbounded financial positions in the presence of uncertainty about the market model

6. STIMULATING COOPERATION AMONG FARMERS IN A POST-SOCIALIST ECONOMY: LESSONS FROM A PUBLIC-PRIVATE MARKETING PARTNERSHIP IN POLAND

7. A Pure Test for the Elasticity of Yield Spreads

8. Connectionism, Analogicity and Mental Content

9. Business Cycle Dynamics of a New Keynesian Overlapping Generations Model with Progressive Income Taxation

10. Moffett and rhetoric