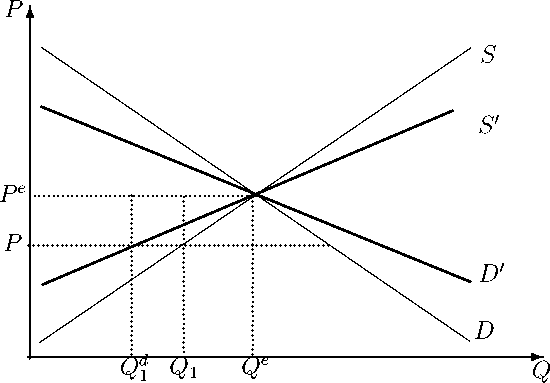

Lemma 2, Q1d is given by

S -1( Qf)+ δPe

1 + δ ’

or

S-1(Qf1) = P+δ(P- Pe)

<P

< S-1(Q1).

In other words, intertemporal arbitrage exacerbates the shortage in the first period as Qf1 <

Q1.

Figure 2: Price setting with binding supply

The exacerbated shortage means that, as compared to the status quo, some additional

buyers are rationed out and hence become worse off in the first period. Moreover, because

they are rationed out in the first period, they will have to purchase the commodity at the

price Pe > P in the second. Thus these users must be worse-off as compared to the status

quo, even inter-temporally. Dual track liberalization can therefore not be Pareto improving

in the dynamic sense.

As it exacerbates the shortage, inter-temporal arbitrage induces an additional efficiency

loss in the first period as compared to the status quo. However, this loss must be weighted

against the efficiency gain achieved by dual track liberalization in the second period. We

More intriguing information

1. Education Research Gender, Education and Development - A Partially Annotated and Selective Bibliography2. Insecure Property Rights and Growth: The Roles of Appropriation Costs, Wealth Effects, and Heterogeneity

3. Rural-Urban Economic Disparities among China’s Elderly

4. Empirically Analyzing the Impacts of U.S. Export Credit Programs on U.S. Agricultural Export Competitiveness

5. The name is absent

6. The name is absent

7. The name is absent

8. The name is absent

9. The name is absent

10. The name is absent