Uncertain Productivity Growth

5 COMPETITION & COMPARATIVE STATICS

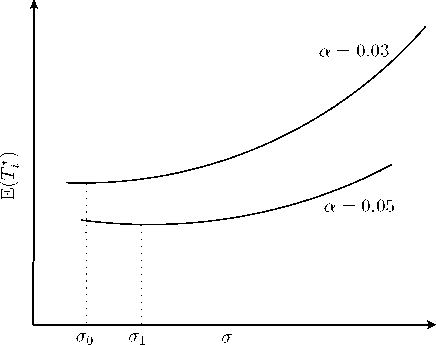

Figure 9: Expected Market Entry Time Pattern

low growth rates tend to dislike uncertainty and postpone their investment decision further into

the future the higher the volatility.

Finally, within the proximity-concentration trade-off framework, a reduction of the expected

market entry time due to an increase in σ is still accompanied by a rise in the range of relative

cost constellations in figure 7 which enforce FDI as the optimal entry strategy. Additionally, one

can conclude that for a firm associated with a high productivity growth rate, a rise in uncertainty

may lead to an earlier market entry.

Result 6:

For IE < IF and wEτ 1 > wF with κ > 1, a rise in productivity volatility σ increases the likelihood

of first time market entry through FDI. There exists a range of uncertainty 0 < σ < σ0 in which

the market entry is preponed. For these parameter constellations the likeliness of market entry

per period increases.

5 The Degree of Competition and Comparative Statics

A crucial aspect for an investor’s first time market entry decision is the degree of competition in

the potential destination country. Within the established framework we can measure the extent

of competition by considering the inverse of the country specific mark-up ν . Demand turns out

to be flat if ν approaches one. In such a case, the investor holds a low degree of market power as

the substitutability between the differentiated goods Xi is high.

36

More intriguing information

1. The name is absent2. Studying How E-Markets Evaluation Can Enhance Trust in Virtual Business Communities

3. The Economics of Uncovered Interest Parity Condition for Emerging Markets: A Survey

4. The Economic Value of Basin Protection to Improve the Quality and Reliability of Potable Water Supply: Some Evidence from Ecuador

5. BILL 187 - THE AGRICULTURAL EMPLOYEES PROTECTION ACT: A SPECIAL REPORT

6. The Nobel Memorial Prize for Robert F. Engle

7. The name is absent

8. The Values and Character Dispositions of 14-16 Year Olds in the Hodge Hill Constituency

9. The name is absent

10. American trade policy towards Sub Saharan Africa –- a meta analysis of AGOA