7. Impulse-Response Analysis

-0.2

0

-0.1

-0.3

10 20 30 40

-0.4

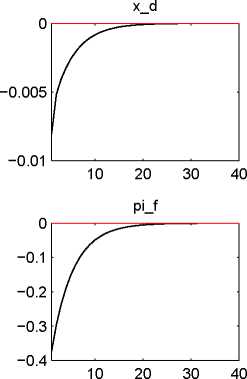

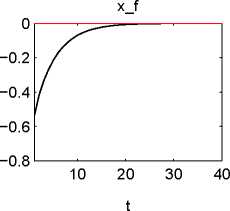

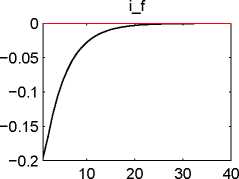

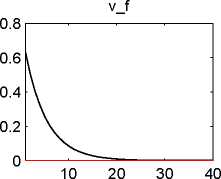

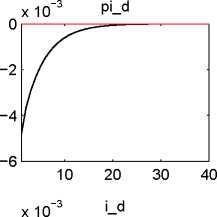

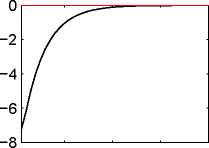

Figure 6: Responses to an impulse on the foreign monetary policy shock

10 20 30 40

An interpretation of the results that can be derived from Figures 1 to 6 can be found in the following.

1. The domestic output gap, PPI inflation and nominal interest rates decrease before they return to

their zero-inflation steady-state values in response to an impulse on the domestic productivity shock

(Figure 1). The TOT first augment, then drop below their zero-inflation steady-state value until

they eventually converge. There is also an impact on all foreign endogenous variables, which is of

the same sign except for the foreign PPI and nominal interest rates. Nonetheless, this impact is

quantitatively small and induces fluctuations.

2. The foreign output gap, PPI inflation and nominal interest rates decrease before they return to

their zero-inflation steady-state values in response to an impulse on the foreign productivity shock

(Figure 2). The TOT first augment, then drop to their zero-inflation steady-state value. There is

also an impact on all domestic endogenous variables, which barely fluctuate. The impact is of the

same sign but quantitatively larger compared to the impact of the domestic productivity shock on

foreign variables. In addition, the US recovers notably faster from a shock on its own productivity

compared to the EU.

3. The domestic output gap decreases, yet the domestic PPI inflation and nominal interest rates in-

crease before all endogenous variables return to their zero-inflation steady-state values in response

to an impulse on the cost-push shocks (Figure 3). The TOT first plummet, then jump above their

zero-inflation steady-state value until they eventually converge. There is also an impact on all for-

eign endogenous variables, which is of the same sign except for the foreign PPI and nominal interest

rates.

4. The foreign output gap decreases, yet the foreign PPI inflation and nominal interest rates increase

before all endogenous variables return to their zero-inflation steady-state values in response to an

impulse on the cost-push shocks (Figure 4). The TOT first augment, then drop below their zero-

inflation steady-state value until they eventually converge. There is also an impact on all domestic

endogenous variables, which is of the same sign except for the foreign PPI and nominal interest rates.

25

More intriguing information

1. The name is absent2. Restructuring of industrial economies in countries in transition: Experience of Ukraine

3. The name is absent

4. Nonlinear Production, Abatement, Pollution and Materials Balance Reconsidered

5. The name is absent

6. The name is absent

7. The name is absent

8. Flatliners: Ideology and Rational Learning in the Diffusion of the Flat Tax

9. The Composition of Government Spending and the Real Exchange Rate

10. Telecommuting and environmental policy - lessons from the Ecommute program